Leading the charge in sustainable financial practices.

While the United States makes strides in sustainable investing, several countries around the globe are significantly ahead in the realm of green finance. These nations have not only embraced environmentally conscious investments but have also woven sustainable practices deeply into their economic policies and financial systems.

Their proactive approaches offer valuable blueprints for how to effectively mobilize capital for a greener future.

1. Norway: pioneering sovereign wealth fund sustainability.

Norway stands out globally for its pioneering approach to green finance, primarily driven by its massive sovereign wealth fund, the Government Pension Fund Global. This fund, one of the largest in the world, has consistently implemented stringent ethical and environmental guidelines, divesting from companies involved in coal, oil sands, and other high-emission activities, while actively investing in renewable energy and sustainable solutions.

This commitment extends beyond divestment to active engagement with companies to improve their ESG (Environmental, Social, and Governance) performance. Norway’s leadership demonstrates how large-scale financial entities can be powerful catalysts for global green transition, setting a high standard for responsible investment.

2. Sweden: an early adopter of green bonds and ESG integration.

Sweden has been at the forefront of green finance for years, being one of the earliest to issue green bonds and consistently integrating environmental considerations into its national financial strategy. Its regulatory framework encourages sustainable investments, and Swedish financial institutions are often leaders in ESG integration, offering a wide range of green financial products.

The country’s strong commitment to sustainability is reflected across its public and private sectors, fostering an ecosystem where green finance is not an afterthought but a core component of economic development. Sweden serves as a model for how a nation can align its financial system with its ambitious environmental goals.

3. Denmark: leading in renewable energy finance and innovation.

Denmark is a global leader in renewable energy, particularly wind power, and its financial sector reflects this focus with robust green finance mechanisms. The country has developed innovative financial instruments and policies to support its transition to a green economy, attracting significant investment in sustainable infrastructure and technologies.

Danish banks and pension funds are highly active in sustainable investing, viewing it as both an ethical imperative and a strategic economic opportunity. Their concentrated expertise in financing green projects offers a powerful example of how national specialization can drive leadership in sustainable finance.

4. The Netherlands: a strong focus on responsible investment and impact.

The Netherlands has a highly developed sustainable finance sector, characterized by its large institutional investors, particularly pension funds, which have a strong focus on responsible investment and generating positive impact. Dutch financial regulations and industry initiatives actively promote the integration of ESG factors into investment decisions.

The country’s emphasis on long-term sustainability and collaborative efforts among financial players has created a robust ecosystem for green finance. The Netherlands demonstrates how a commitment to ethical investing can be scaled across an entire financial system, influencing global investment trends.

5. Germany: driving green industrial transformation.

Germany has positioned itself as a leader in green finance through its ambitious Energiewende (energy transition) policy, which aims to shift the country to renewable energy sources. This massive undertaking has driven significant investment in green technologies and infrastructure, supported by a strong framework for green bonds and sustainable banking practices.

German financial institutions are increasingly integrating sustainability into their core operations, viewing it as essential for long-term economic stability and competitiveness. Germany’s approach highlights how national industrial policy can synergize with financial innovation to accelerate a green transformation.

6. France: leading with comprehensive sustainable finance regulations.

France has adopted some of the most comprehensive and progressive sustainable finance regulations globally, requiring institutional investors to disclose how they integrate ESG factors and measure their climate impact. This top-down regulatory push has significantly accelerated the adoption of green finance practices across its financial sector.

The French government has also been a strong issuer of green bonds, demonstrating its commitment to financing environmental projects. France’s proactive regulatory environment serves as a powerful example of how policy can effectively drive sustainable investment at a national level.

7. The United Kingdom: positioning as a global green finance hub.

The UK has made significant strides in positioning London as a global hub for green finance, with strong government support for sustainable investment and a growing market for green financial products. The country is actively developing regulations and initiatives to attract green capital and facilitate climate-related financial innovation.

The City of London’s vast financial expertise and global reach make it a natural contender for leadership in sustainable finance. The UK’s efforts demonstrate how a major financial center can pivot its capabilities towards supporting the global green transition.

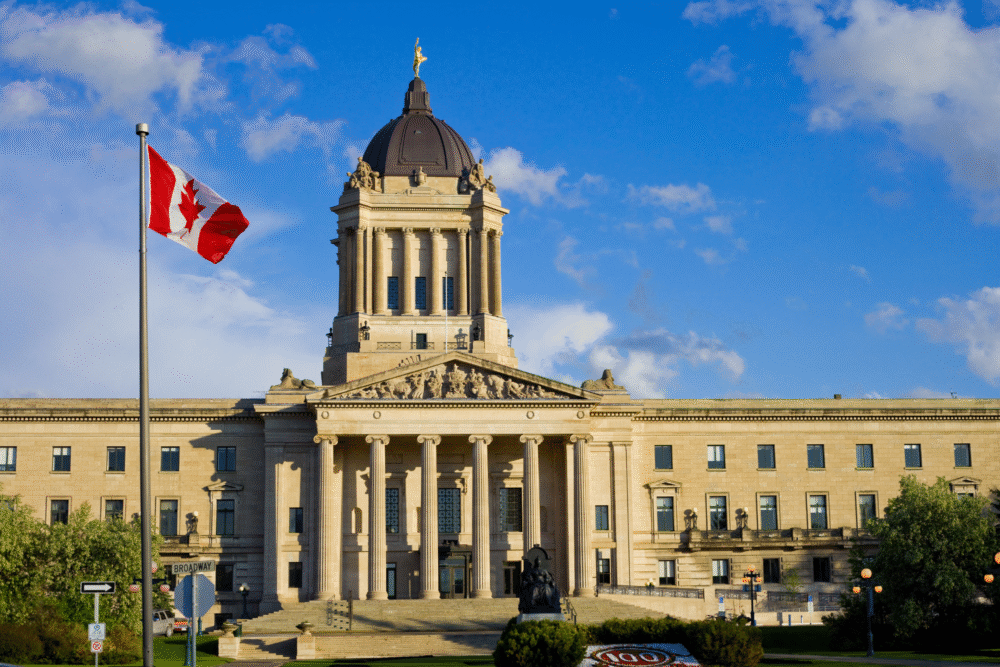

8. Canada: leveraging natural resources for sustainable development.

Canada, despite its traditional resource-based economy, is making significant progress in green finance, particularly in developing sustainable solutions for its natural resource sectors and investing in clean technologies. Canadian pension funds are increasingly integrating ESG factors into their investment strategies, both domestically and internationally.

The country’s focus on sustainable resource management and innovation in clean energy provides a unique angle to green finance. Canada’s approach highlights how a nation can transition its core industries towards more sustainable practices through strategic financial investment.

9. Switzerland: a hub for sustainable wealth management.

Switzerland, known for its strong financial services sector, is increasingly becoming a hub for sustainable wealth management and private banking, catering to high-net-worth individuals and families interested in ESG-aligned investments. Swiss banks are developing sophisticated green financial products and advisory services.

The country’s reputation for financial stability and innovation, combined with its commitment to sustainability, makes it an attractive destination for green capital. Switzerland’s focus on private wealth management offers a distinct model for how green finance can flourish within a specialized financial niche.

10. Japan: growing commitment to ESG and climate transition finance.

Japan, while a later entrant compared to some European nations, is rapidly increasing its commitment to green finance, driven by growing awareness of climate risks and opportunities. The government and major financial institutions are promoting ESG investing, green bonds, and climate transition finance to support its decarbonization goals.

The country’s strong technological capabilities and large institutional investor base position it to become a significant player in the global green finance landscape. Japan’s accelerating efforts demonstrate how a major economy can quickly scale up its sustainable financial practices.