Understanding which states pay more in federal taxes than they receive in aid reveals fiscal imbalances.

Several U.S. states consistently contribute more money to the federal government in taxes than they receive back in federal aid. This fiscal imbalance is shaped by factors such as economic diversity, industrial strength, and demographic profiles. Recognizing which states are net contributors helps clarify ongoing debates about federal spending priorities and state budget strategies, highlighting the complex nature of interstate economic relationships and national fiscal policy.

1. California leads with the highest contribution exceeding its federal aid received.

California’s vibrant economy results in substantial federal tax contributions, far exceeding what the state receives in federal aid. Robust industries like tech and entertainment generate significant tax revenue, which bolsters California’s role as a major federal tax contributor.

Despite the high cost of living, the state’s economic diversity ensures a continuous influx of tax dollars to the federal government. This fiscal imbalance influences California’s state budget planning, requiring creative strategies to manage public services without relying heavily on federal aid.

2. Texas consistently contributes more in federal taxes than it gains back.

Texas stands out for its consistent fiscal contribution, sending more in federal taxes than it receives in return. A dynamic energy sector and a growing population contribute to this financial outflow, enhancing its net contributor status.

Such regular contributions impact Texas’s economic and political landscape, often fueling debates on federal spending priorities. The state’s economic strength emerges partly from its ability to leverage minimal aid while fostering growth through substantial local investment in infrastructure and services.

3. New York ranks among the top states paying more than federal aid received.

New York emerges as a significant payer of federal taxes, surpassing the amount of federal assistance it receives. Its financial hub, Wall Street, generates immense revenue that markedly boosts federal tax receipts, confirming New York’s position as a fiscal cornerstone.

The state’s economic clout not only influences local policy but also ripples into national budget discussions. Despite the imbalance in aid, New York maintains its cultural and economic influence, supported by its strategic investments in public goods and infrastructure.

4. Florida is a significant net contributor through federal tax payments.

Florida’s vibrant tourism sector significantly enhances its federal tax contributions, making the state a notable net contributor. Frequent visitors and robust real estate markets enrich its tax base, providing considerable revenue to the federal government.

This financial pattern shapes Florida’s fiscal strategies, highlighting an economy less reliant on federal aid funnels. The state’s resilience underscores its capability to manage growth and services independently, offering insights into balancing state and federal financial dynamics.

5. Illinois regularly provides more federal tax revenue than it obtains in aid.

Illinois frequently sends more in federal taxes than it receives in aid, driven by its industrial base and strategic location as a transportation hub. Major cities like Chicago generate vast revenue streams, reinforcing Illinois as a strong federal tax contributor.

The fiscal dynamic impacts Illinois’s strategy in balancing its budgetary needs. Despite consistently higher outflows, Illinois capitalizes on its industrial and cultural assets to fuel economic growth and drive essential infrastructure projects rather than heavily depending on federal subsidies.

6. Pennsylvania contributes a greater share of federal taxes compared to aid received.

In Pennsylvania, federal tax outflows consistently surpass the aid received, largely due to its diverse economic landscape. Major industries, from energy to education, bolster considerable tax contributions, securing Pennsylvania’s place among prominent net contributors.

This fiscal trend influences public policy and expenditure priorities within the state. Although receiving less in federal aid, Pennsylvania relies on its industrial heritage and academic institutions to maintain economic stability and navigate budgetary challenges without overspending.

7. Ohio consistently gives more in federal taxes than the amount of aid it gets.

Ohio’s tax contributions to the federal government consistently outpace the federal aid it receives. The state’s manufacturing legacy and diverse economic sectors contribute significantly to this imbalance. Ohio remains a steady net contributor within the national fiscal framework.

Such dynamics reveal insights into Ohio’s economic resilience and public investment strategies. Despite a lower proportion of federal aid, Ohio utilizes its industrial strengths to support public services and stimulate local growth through strategic economic planning and investments.

8. Virginia ranks high in federal tax contributions exceeding federal aid inflows.

Virginia’s position as a high-ranking federal tax contributor stems from its mix of defense contracting and technology sectors. Federal government proximity bolsters its revenue, with tax contributions exceeding aid inflows significantly.

This fiscal relationship shapes Virginia’s local governance and service provision frameworks. Even with federal expenditure tied to government operations, Virginia’s economy thrives by leveraging federal proximity and fostering business innovation, supporting a relatively autonomous fiscal model with reduced dependency.

9. New Jersey contributes more to federal taxes than it receives in assistance.

New Jersey consistently contributes more to the federal Treasury than it receives back. Its strategic location and robust financial services sector play a vital role in generating substantial tax revenues. New Jersey emerges as a key player among net contributors.

These dynamics influence state-level economic policies, with a continued focus on leveraging strategic location advantages. Despite less federal financial support, New Jersey fosters economic growth and funds public services by optimizing resource allocation to stimulate local economic development.

10. Washington State is among those paying more into federal funds than it takes.

In Washington State, federal tax contributions regularly overshadow aid received. Its economy, fueled by technology and aerospace industries, drives substantial revenue to the federal government. Washington stands out as a prominent contributor, adding more to federal coffers than it takes.

This economic complexion shapes public service and infrastructure investments at the state level. Thriving industry sectors mitigate reliance on federal aid, underscoring a model of leveraging innovation to sustain local economies. Washington reflects a dynamic balance in its fiscal and policy strategies.

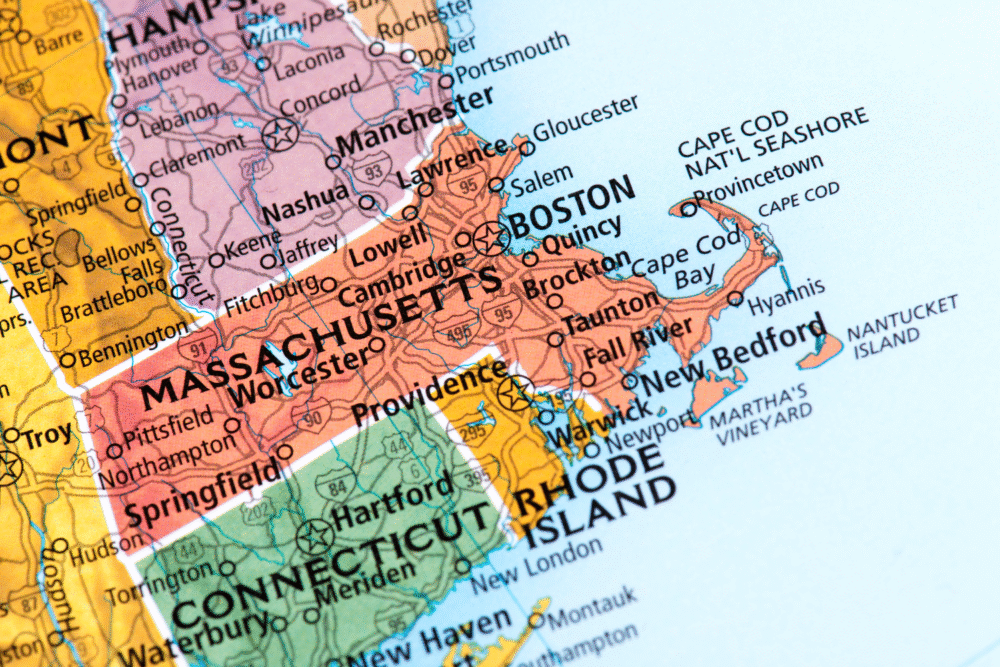

11. Massachusetts is notable for its higher federal tax payments relative to aid received.

Massachusetts is notable for its high federal tax payments relative to aid received, relying on advanced education and healthcare sectors for substantial economic contributions. This economic muscle solidifies its status as a net contributor.

State economics and policy strategies are continually adjusted to match this fiscal landscape, optimizing local investment despite minimal federal aid returns. Massachusetts capitalizes on its academic and healthcare expertise to maintain an innovative edge, supporting public services through robust, self-sustaining economic frameworks.