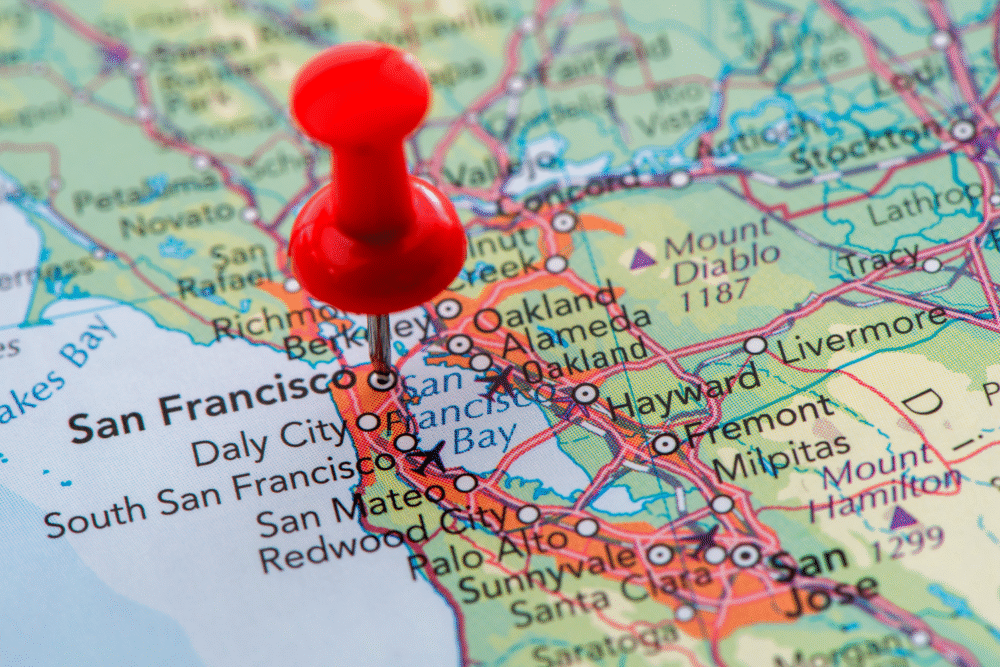

Understanding the complex mix of economic and regulatory forces behind San Francisco’s stubbornly high living costs.

San Francisco’s cost of living remains notably high despite population shifts, shaped by a constellation of persistent factors. From its restricted housing supply and strict zoning laws to the influence of high-paying tech jobs, multiple economic and social dynamics interplay. Urban amenities, geographic constraints, and taxation also contribute, while income inequality and infrastructure challenges sustain elevated expenses. These elements together create a resilient cost structure, supported by data from experts like the Federal Reserve and OECD.

1. Limited housing supply drives prices far beyond demand.

San Francisco’s housing supply struggles to meet demand due to limited space and extensive regulatory hurdles. The city’s geographical boundaries, cradled by the Pacific, restrict sprawling development. With fewer properties available, the competition spikes, driving up costs as potential buyers jostle for position.

Infrastructure like water and sewage further complicates housing growth. Even with shifts in population numbers, the chronic shortage persists, sustaining the high prices. Urban expansion isn’t straightforward, as strict zoning laws also constrain building efforts, maintaining the pressure on an already saturated market.

2. High demand for tech jobs inflates local salaries and rents.

A dense tech industry in San Francisco creates an influx of high-income roles, often outpacing local salary norms. Companies like those in Silicon Valley foster competitive wages, which, while beneficial for employees, also bolster the housing market’s appetite. Rent prices reflect this surge robustly.

Consequently, local businesses and service sectors adapt to this economy, pricing their offerings accordingly. This environment can result in disparities, as individuals in service roles struggle to keep pace with the disposable income of their tech-industry counterparts, perpetuating an uneven landscape.

3. Strict zoning laws restrict new residential construction projects.

San Francisco enforces stringent zoning laws, limiting the construction of new residential projects. These laws safeguard neighborhood character but scale back available housing options. Urban planners face challenges in approving developments, slowing possible expansion in housing availability.

The trade-off between cultural preservation and growth demands careful balance. When zoning restrictions prevail, developers turn to more profitable, luxury-level developments, sacrificing affordability. High-income residents often absorb this limited supply, sidelining middle- and low-tier housing needs amid such regulatory environments.

4. Premium urban amenities attract wealthier residents consistently.

Urban amenities in San Francisco, like its waterfront parks and cultural institutions, attract affluent residents steadily. These amenities uphold the city’s appeal, boosting property desirability and value. From renowned theaters to innovative dining, these luxuries engrain a specific social aura.

However, while amenities elevate life quality, they inadvertently raise the baseline cost of living. As affluent individuals occupy these urban realms, the city’s identity shifts slightly, converting community-specific spaces into bigger attractions, a transformation that can exclude less-wealthy populations.

5. Geographic constraints limit the city’s expansion possibilities.

San Francisco’s geographic barriers, with water surrounding most of the city, restrict expansion. Natural constraints, coupled with terrain that ranges from steep hills to earthquake considerations, curtail outward growth effectively. This physical limitation keeps available land a scarce commodity.

When expansion isn’t an option, developers must focus on vertical growth or optimizing existing spaces. The lack of sprawl implies intensified demand within confined boundaries. Even as zoning tries to address these confines, room for maneuver remains limited, pushing prices upward.

6. Competitive bidding significantly increases home purchase cost

Intense competitive bidding on San Francisco homes ramps up purchase costs significantly. Bidders often go beyond listed prices, sparking bidding wars that drive values skyward. This behavior not only inflates sellers’ expectations but also sets high benchmarks for future deals.

Such financial battles usually favor cash-rich buyers over others with traditional financing. As a result, those eyeing homeownership may find themselves eclipsed by competition, setting a precedent where elevated transaction prices become the norm, creating a cycle of affordability challenges.

7. Local taxes and fees contribute to overall living expenses.

Living costs in San Francisco feel the weight of local taxes and fees. Together, these financial obligations add layers to residents’ monthly budgets. From property taxes to service fees, the city’s revenue channels filter through housing and utilities significantly.

Despite population fluctuations, the structural underpinning of these costs persists. They support public services and infrastructure but require residents to bear higher expenditure thresholds. As services cater to diverse yet concentrated community needs, the physical and fiscal overlay remains intricate.

8. Strong rental markets discourage landlords from lowering prices.

Strong rental markets in San Francisco dissuade landlords from dropping prices. Even amid population changes, sustained demand for housing ensures consistently attractive returns. Rent control and limited housing supply enable rent prices to stay high despite dips in occupancy.

Landlords anticipate rents yielding steady profit margins. With a notable inflow of transient workers who often pay premium prices, landlords avoid price cuts. Long-term agreements don’t wane easily, propping market persistence and dissuading renegotiations even if buyer interest shifts.

9. Popular cultural and recreational options enhance area desirability.

San Francisco shines enticingly, brimming with diverse cultural and recreational options. This vibrancy fosters desirability, drawing in residents who appreciate unique local flavors like the fog-shrouded Golden Gate Park. These lifestyle offerings align finely with communal pride.

Such attractiveness sustains incoming interest, urging urban development and entrepreneurial ventures. However, the crowding effect inherently uplifts the overall cost framework as social draws retain powerful influence. The local economy’s dynamism both nourishes and amplifies living expenses.

10. Influx of remote workers boosts housing demand unpredictably.

Remote workers find San Francisco’s appeal unpredictable yet undeniable, and their presence influences housing demand patterns erratically. Home offices, once rarities, now shape the real estate market as more jobs shift toward flexible arrangements.

Residences with conducive remote-work features maintain enhanced allure. While remote influx doesn’t solely dictate market rates, such dynamics permeate the broader housing landscape as flexible workers integrate desired locales into live-work possibilities, consummating both tech-humanistics alignments.

11. Limited public transportation intensifies reliance on costly cars.

San Francisco’s reliance on limited public transportation options forces many to depend on costly vehicle ownership. Public systems, though extensive, grapple with efficiency and reach, nudging commuters toward private car usage as an alternative to navigating urban geography.

While transit improvements can ease some strain, cars remain synonymous with broader personal expenses. Insurance, gas, and downtown garage fees compound costs in this vehicular landscape. Thus, autofocused commuting embedding shapes budgeting intricacies considerably.

12. Wealth concentration creates high-end markets affecting affordability.

Wealth concentration in San Francisco forms a strata-rich economy, creating progressive high-end markets. Boutiques and niche retailers thrive under this influence, securing premium clients typically seen in the dense, prosperous regions of California.

The effect of wealth pooling signifies extraordinary discretionary spending, raising price floor standards. Practical goods and services eventually mirror luxury precedents, limiting accessibility. Such microcosms of economic affluence bolster exclusivity, weaving a coherent thread through the city’s affordability fabric.