Avoid common pitfalls to improve your use of the envelope budgeting system effectively.

The envelope system is a popular method for managing personal finances by allocating cash into specific spending categories. However, users often encounter budgeting mistakes that can undermine their efforts to control spending and save money. Issues like inaccurate expense tracking, mixing funds across envelopes, and neglecting to update budgets over time can lead to overspending and financial frustration. Understanding these common errors helps improve discipline and financial planning success with this cash-based approach.

1. Overfilling envelopes and losing track of available funds.

Overfilling cash envelopes can quickly obscure your financial picture. When excess cash piles up in one category, spending becomes harder to track, and the risk of unplanned splurges increases. A wallet bulging with extra cash may inadvertently suggest a false sense of security.

Underestimating just how much extra cash is in an envelope can lead to spending mistakes. What begins as a casual coffee stop might evolve into larger, less controlled purchases. Sticking to initially planned amounts allows for better financial discipline and clearer budget visibility.

2. Forgetting to adjust envelopes when income or expenses change.

Budgets remain dynamic, fluxing with life changes and varying expenses. When income increases or expenses shift, failing to adjust envelopes disrupts budgeting effectiveness. It’s critical to sync these economic fluctuations with your cash allocation to sustain effective money management.

Staying responsive to income or expense changes fosters a more resilient financial plan. For instance, seasonal utilities or unexpected bonuses may require adjusting the amounts in corresponding envelopes. Maintaining alignment between cash flow and envelopes ensures your budget adapts to real-world scenarios.

3. Mixing personal and shared expenses in the same envelopes.

Mixing personal and shared expenses can complicate financial tracking. When envelopes bear both individual and communal transactions, understanding who spent what blurs—all for the price of convenience. Co-mingled funds can obscure accountability, which is crucial for effective money management.

Keeping separation between personal and shared funds clarifies financial responsibilities. Whether splitting a grocery bill with a roommate or sharing transportation costs, distinct envelopes provide clearer financial boundaries and minimize disputes. Such delineation fosters clearer, simpler financial conversations.

4. Neglecting to track receipts and overspending in cash categories.

Tracking receipts diligently facilitates accountability in spending categories. Cash evaporates quickly, and without tracking receipts, overspending may go unnoticed until envelopes are empty. A small shoe box or dedicated pouch can help collect daily receipts for periodic review.

Taking the habit of recording receipt details unlocks insights into spending patterns. Over time, consistent recording reveals trends and hidden splurges. This knowledge empowers more informed decisions and adjustments in future budgets, promoting healthier financial habits rooted in reality.

5. Avoiding digital tools that can complement the envelope system.

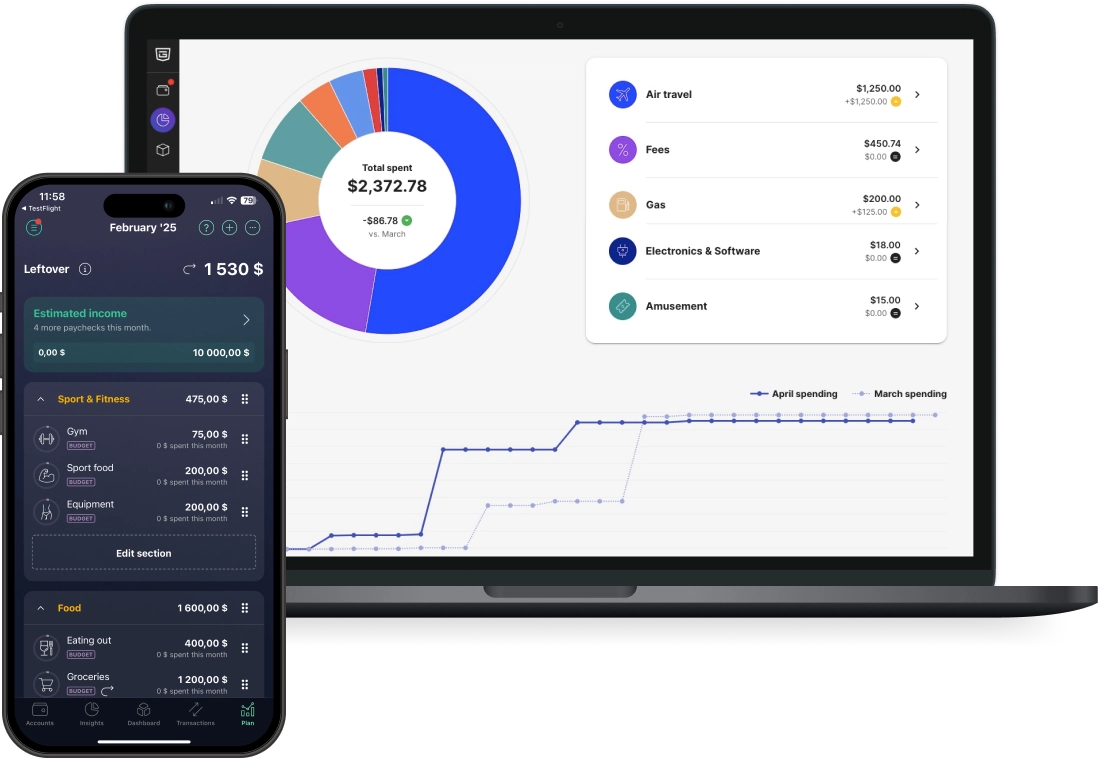

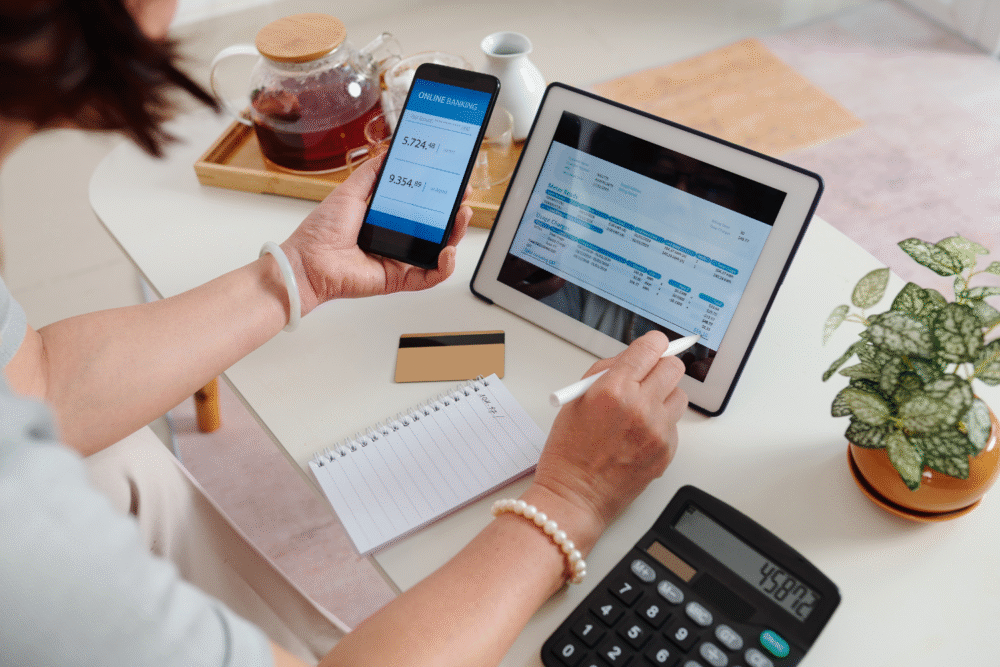

Digital tools offer a modern twist to the envelope system, enhancing efficiency without replacing it. Apps and spreadsheets can track weekly expenditures, alerting you when categories near depletion. Such tools lie alongside physical envelopes, providing a richer picture of financial health.

Incorporating digital solutions integrates real-time updates and convenient summaries. Allowing technology to complement traditional methods brings nuanced understanding and adaptability to your budget. Whether it’s setting alerts or capturing purchase data, digital tools offer new dimensions and clarity.

6. Setting unrealistic spending limits that cause constant envelope shortages.

Setting unrealistic spending limits brings inevitable frustration. When envelopes run dry mid-month due to overly tight constraints, financial chaos ensues. Scarce resources can lead to reliance on credit or borrowing, which contradicts the envelope system’s values.

Realism in setting budget limits creates more sustainable money management. By acknowledging honest financial needs, you institute envelopes that truly reflect spending habits. This approach not only matches limits to real-world demands but also fosters confidence and financial stability.

7. Ignoring regular envelope reviews and failing to update budget goals.

Regular envelope reviews ground budget goals in reality. Over time, unchanged budgets can inadvertently neglect evolving priorities or income shifts, rendering them outdated. Envelopes become silent witnesses to progress stagnation if left unchecked over long periods.

Frequent evaluations ensure your budgeting aligns with current goals and aspirations. Consider how life changes or newfound priorities necessitate fine-tuning allocations. Refreshing envelope goals keeps financial objectives dynamic, aligned with continuous life evolution.