Eight economic and social factors reshaping the financial stability of middle-income Americans today.

The American middle class faces a complex set of challenges that have eroded economic stability over recent decades. Factors including stagnant wages, rising living costs, and shifts in employment patterns contribute to tightened budgets and diminished upward mobility. Insights from authoritative organizations like the BLS and Federal Reserve highlight how income inequality, automation, and housing affordability intersect, complicating the financial landscape for millions of households.

1. Stagnant wages limiting growth for middle-income households.

Wages for many middle-income households have barely budged in decades. Even as other economic indicators improve, paychecks for the average worker fail to stretch further. Rising productivity benefits often bypass employees, concentrating gains at the higher echelons of companies.

Consequently, even small leaps in the cost of living can tip household budgets into distress. As groceries and utilities skim the household purse, discretionary spending shrinks. Families accustomed to modest comforts now navigate tighter financial terrain, searching for ways to maintain their standard of living.

2. Rising costs of education creating financial pressures.

Tuition hikes add financial strain as families strive for education that was once a reliable ladder to upward mobility. Student debt climbs alongside these costs, altering long-term financial planning. This trend deepens economic anxiety for the average family.

Such pressures often force parents and students to weigh educational value against mounting fees. The balancing act between aspirations and affordability highlights how financial decisions now consider implications beyond immediate expenses. Families increasingly scrutinize the financial returns of degrees, shifting expectations around education.

3. Increased healthcare expenses draining family budgets.

Health insurance premiums and out-of-pocket medical costs rise quickly, surpassing growth in wages. This trend dramatically affects households, making healthcare a primary budget concern. Medical bills, whether from routine care or emergencies, stress financial reserves.

In extreme cases, medical expenses push families toward financial instability, affecting everything from credit scores to savings. Even common medications and procedures can generate formidable costs. As insurers and providers negotiate behind the scenes, individuals grapple with navigating coverage and calculating co-pays.

4. Shifts in the job market reducing stable employment opportunities.

Evolving market forces have shifted job stability, replacing long-term security with short-term contracts. As businesses prioritize flexibility, traditional roles diminish, offering fewer benefits and lower assurance. Workers face new challenges navigating this changing landscape.

Adaptation becomes crucial, as industries once synonymous with stable careers now favor adaptability and digital proficiency. The gig economy provides alternatives, yet often lacks the benefits of standard employment. Workers frequently strategize around role diversification to remain competitive and secure.

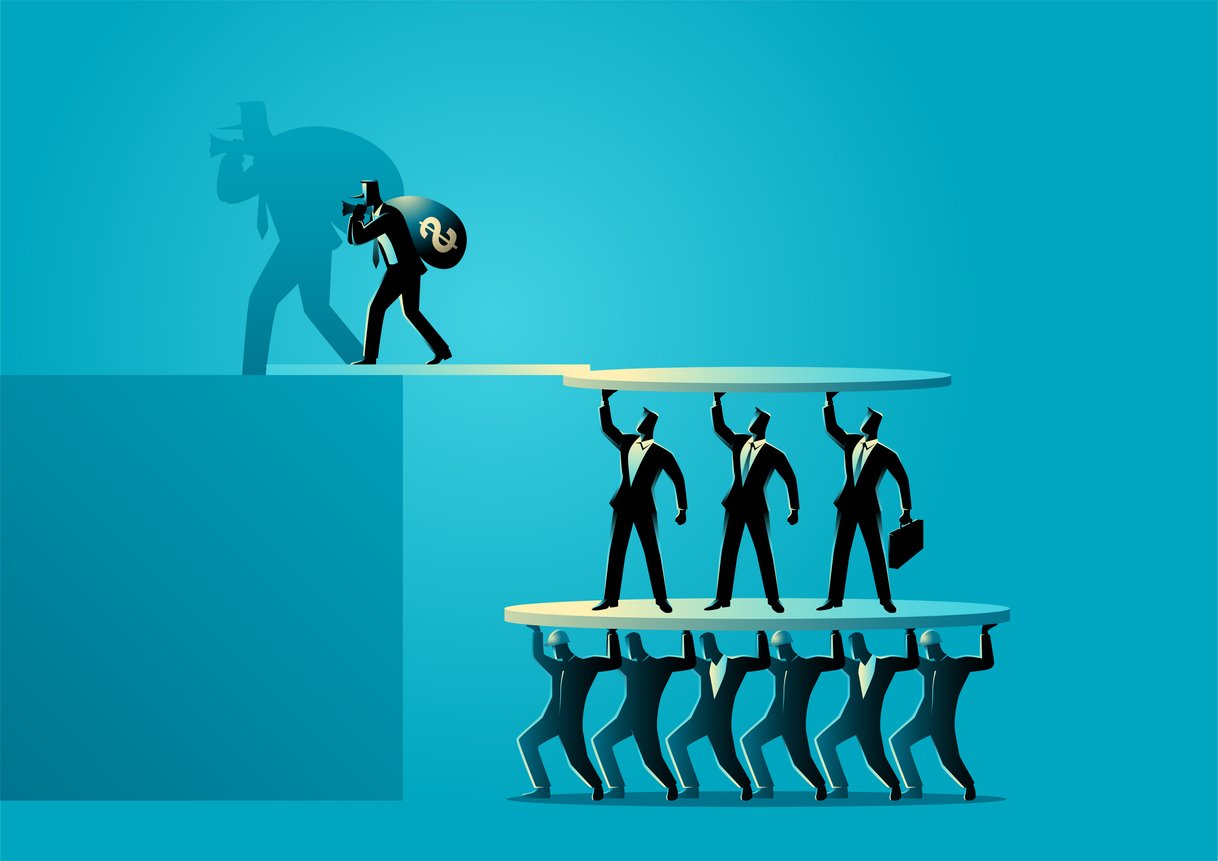

5. Growing income inequality widening the economic divide.

Disparities in income distribution intensify economic divides, leaving middle-income households squeezed. As the wealthiest accumulate more assets, those in median brackets face challenges in maintaining financial growth. The widening gap disrupts cohesion, affecting broader society.

This imbalance often mirrors inequities in education, housing, and healthcare access, amplifying the struggle for average households. Such disparities can exacerbate community tensions, influencing public sentiment and policy discussions. The lived experience of the middle class in this context reveals growing socioeconomic stratification.

6. Housing affordability challenges squeezing middle-class living standards.

Skyrocketing property prices and rental rates magnify housing affordability challenges, pressuring middle-class budgets. Home ownership, a traditional wealth-building tool, becomes elusive for many. Rising demand in urban centers amplifies these financial hurdles, reshaping living choices.

Suburban migration sometimes alleviates costs, yet adds commuting burdens and job access issues. Families recalibrate around neighborhoods offering balance between cost, comfort, and connectivity. As the housing market evolves, these considerations reflect broader shifts in lifestyle and economic priorities.

7. Technological advancements disrupting traditional industries and roles.

Technological changes, like automation, transform industries and redefine job roles across sectors. While some embrace these innovations, others encounter disruption. Machines achieve tasks once reserved for human hands, altering traditional workforce dynamics considerably.

This shift prompts reevaluation of skill sets and career trajectories, urging many to pursue new training. Rapid advancements unsettle established pathways, driving demand for resilience and versatility. The adjustment period holds potential for both new opportunities and heightened uncertainty.

8. Reduced union membership weakening collective bargaining power.

Declining union membership corresponds with diminished collective bargaining power, affecting key labor negotiations. Without this leverage, employees face stagnant wages and reduced benefits, altering the workplace landscape over decades. Unions traditionally advocated for better conditions and rights.

Consequences span beyond individual negotiations, influencing broader labor market trends. As unions weaken, organizations may prioritize cost-cutting, impacting job security and earnings. This shift in labor dynamics necessitates reassessment of collective strategies among workers seeking equitable employment terms.