Avoid common pitfalls by recognizing money-saving habits that can lead to financial loss.

Many people adopt money-saving habits hoping to improve their finances, but some methods backfire and cause overspending or hidden costs. Understanding which common habits lead to financial setbacks helps individuals make smarter choices. Evaluating the true cost of these strategies and focusing on long-term benefits protects personal finances from unintended consequences. This guide highlights key pitfalls to avoid for healthier budgeting and spending habits.

1. Constantly clipping coupons without checking prices wastes valuable time.

Constantly clipping coupons can lead to more than just savings. Without checking if the discounted price is actually a deal, one might end up spending more on items that aren’t needed. Furthermore, the time spent hunting for deals might outweigh the savings achieved.

Continuously focusing on coupon availability sidetracks from the essential evaluation of an item’s actual necessity. Over time, these small purchases can add up to significant amounts. Balance is key, ensuring time spent clipping aligns with genuine economic benefits, rather than compulsive habit building.

2. Skipping maintenance on appliances leads to costly repairs later.

Skipping regular maintenance on appliances seems like a smart savings strategy at first. Many believe that avoiding routine costs conserves cash. However, neglecting these checkups often leads to severe malfunctions, resulting in expensive repairs or even equipment replacement.

When maintenance is overlooked, minor issues can escalate into substantial problems, demanding more comprehensive interventions. Protecting appliance longevity prevents sudden financial burdens. Investing in periodic checks ensures optimal performance and longevity, reducing the risk of unexpected expenditures and the inconvenience of breakdowns.

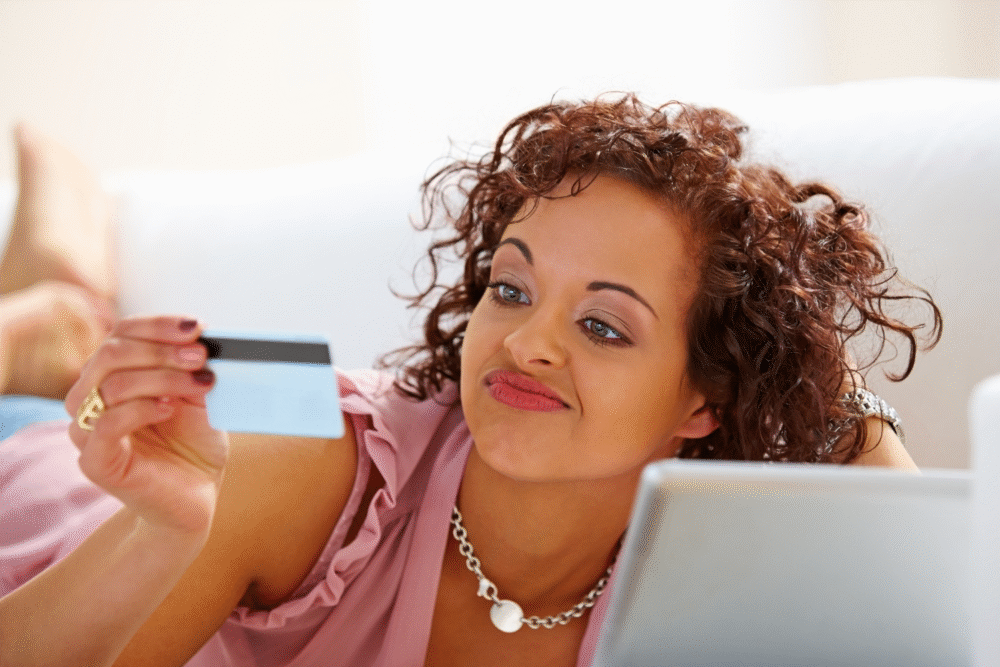

3. Overusing credit cards triggers high-interest charges and debt accumulation.

Credit card overuse initially appears helpful for managing month-to-month expenses. The easy access to funds often encourages continuous use. However, accumulating debt quickly spirals into high-interest payments, turning temporary solutions into long-term financial burdens.

As interest compounds, minimal payments delay debt reduction. Opting for credit use without a solid repayment plan sets the stage for spiraling costs. Prioritizing timely payments and understanding interest dynamics helps prevent debt accumulation, maintaining healthier financial stability over time.

4. Buying items on sale without real need increases unnecessary spending.

Purchasing items simply because they’re on sale often seems like a savvy shopping move. It feels rewarding to snag deals, but these savings may be deceptive. Buying unnecessary items rather than essentials increases expenditure without adding real value.

Sale prices often tempt consumers into acquiring products outside of their regular needs. This behavior fosters clutter and strains budgets. Rethinking purchasing habits ensures resources are allocated towards vital and meaningful expenses, sustaining financial health.

5. Coupon stacking can cause overlooked product quality issues and dissatisfaction.

Coupon stacking serves as an enticing way to maximize offers on purchases. However, focusing solely on savings can lead buyers to ignore product quality. In pursuit of deals, the emphasis might shift away from evaluating the true worth or practicality of acquired goods.

Disappointment arises when emphasis on discounts detracts from product satisfaction. Ensuring quality remains a priority prevents long-term dissatisfaction, avoiding additional costs for replacements or repairs. Effective purchasing goes beyond immediate savings, aligning with long-term satisfaction.

6. Extreme bargain hunting encourages impulse purchases on non-essential goods.

Extreme bargain hunting excites shoppers with the prospect of reduced prices. However, aggressive deals can encourage impulsive buying of non-essentials, undermining disciplined spending. The thrill of acquiring seemingly valuable items often masks their lack of actual utility.

Indulging in bargains without genuine need strains financial resources unnecessarily, shifting focus from essential needs. Practicing mindful spending cultivates more controlled buying habits, steering clear of momentary elation that counteracts wiser budgeting strategies.

7. Avoiding bulk purchases misses out on significant long-term savings.

Avoiding bulk purchases prioritizes immediate cash retention, but it overlooks future savings potential. Single-item buying often results in repeated expenses, missing quantity discounts or reduced unit pricing. This approach can lead to higher long-term costs compared to strategic bulk buys.

Bulk purchases for staple items align with consistent demand, providing noticeable financial benefit over time. When carefully planned, buying in larger quantities streamlines expenditure, contributing to more effective budgeting and resource allocation.

8. Relying solely on cashbacks ignores better discount opportunities elsewhere.

Cashbacks offer enticing incentives for basic consumer purchases. However, relying exclusively on these rebates might ignore larger savings opportunities. If other discount methods are overlooked, potential cost reductions remain untapped.

Exploring diverse promotional options enhances financial gain rather than limiting focus to cashbacks. Comprehensive review of all available perks maximizes savings and aligns with broader consumption strategies, ensuring more holistic financial benefit.

9. Repairing outdated gadgets repeatedly often costs more than replacements.

Consistently repairing outdated gadgets may initially seem economical. However, frequent service costs and diminishing performance often outweigh the expenses of upgrading to improved models. As technology advances, older machinery’s maintenance frequency can increase, escalating overall costs over time.

Investing in newer models sometimes proves prudent, minimizing recurrent issues. Analyzing total repair expenses versus replacement costs aids resource-efficient decision-making, aligning with sustainable financial planning.

10. Neglecting subscription reviews results in paying for unused services.

Subscription services often lure users with minor monthly costs, easily forgotten over time. Neglecting regular reviews results in ongoing fees for unused services. As needs or interests shift, unnoticed subscriptions continue to drain resources unnoticed.

Conducting periodic assessments ensures fees accurately reflect current preferences, preventing unnecessary expenditure. Mindful review fosters prudent budgeting, maintaining a streamlined spending profile aligned with ongoing financial goals.