Discover how key economic indicators can reveal an impending deeper economic downturn.

Economic indicators play a crucial role in revealing the health of the economy and signaling potential downturns. Experts analyze data such as GDP growth, unemployment rates, inflation, and consumer confidence to gain a comprehensive understanding of economic trends. Monitoring a balanced mix of these indicators, guided by authoritative sources like the Federal Reserve and IMF, helps identify warning signs before a deeper economic downturn unfolds.

1. Gross Domestic Product growth rate reveals overall economic health trends.

Gross Domestic Product, or GDP, growth rate acts as a comprehensive measure of a country’s economic performance. It encapsulates the total value of goods and services produced and provides insights into economic activities and trends. A declining GDP growth rate may suggest economic stagnation.

Understanding GDP trends can help gauge whether an economy is expanding or contracting. Historically, consistent declines in GDP have been closely linked with broader recessions. However, short-term fluctuations must be interpreted cautiously, as they might not always indicate long-term economic health changes.

2. Unemployment rate measures the percentage of the labor force without jobs.

The unemployment rate reveals the percentage of people in the labor force without jobs. As a critical lagging indicator, it provides insights into the economy’s health by indicating how many people cannot find work. High unemployment suggests less productivity and consumer spending.

However, interpreting unemployment rates requires nuance. A sudden rise might not always signal an impending recession, as jobless claims can be influenced by other factors like seasonal hiring patterns. Examine trends over several months for more accurate economic insights.

3. Consumer confidence index reflects public optimism about economic conditions.

The consumer confidence index measures the degree of optimism that consumers feel about the overall state of the economy. High confidence levels indicate that consumers feel secure and are likely to spend, which fuels economic growth. Conversely, low confidence may signal reduced spending.

Confidence indexes can precede economic trends since they reflect future spending behavior. A declining consumer confidence index can predict downturns if no positive factors emerge to restore optimism. Consider global events or national policies that might temporarily influence consumer perceptions.

4. Housing market activity shows trends in home sales and construction starts.

The housing market provides crucial data on economic vitality by tracking trends in home sales and construction starts. Increased activity often implies robust economic conditions, while a slowdown might hint at potential downturns. Housing demand can indicate consumer confidence and financial stability.

Conversely, overactive markets might suggest a housing bubble, leading to sudden corrections. Observing patterns in housing permits and mortgage rates helps ascertain underlying economic health. Comparing regional variations can also uncover local economic disparities.

5. Stock market performance indicates investor sentiment and future economic outlook.

Stock market performance acts as a barometer of investor sentiment and potential economic directions. Rising indexes generally reflect confidence and expected growth, while declining trends might suggest caution or anticipated downturns. Stock prices can react quickly to news, impacting economic projections.

However, stock markets can be volatile and influenced by non-economic factors. Sudden shifts might not always have lasting economic implications, emphasizing the importance of examining long-term trends and considering the broader context of market movements.

6. Inflation rate tracks the rise in prices for goods and services.

Inflation rate tracks changes in the prices of goods and services, indicating purchasing power shifts. Moderate inflation is usually seen as a sign of a growing economy, while rapidly increasing or sharply decreasing prices can signal economic instability or downturns.

Economic health can be further understood by considering which goods or services drive inflation changes. Supply chain issues or policy adjustments might temporarily affect inflation. Investigating the root causes of inflation trends allows nuanced understanding beyond the headline figures.

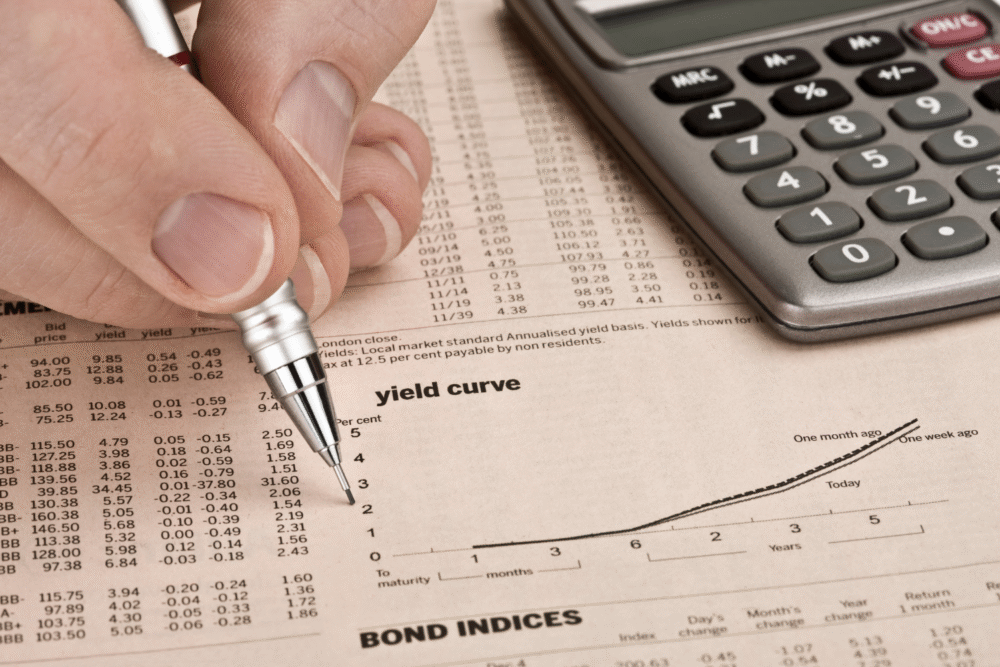

7. Yield curve inversions often signal potential upcoming economic recessions.

A yield curve inversion occurs when short-term interest rates surpass long-term ones, considered a strong potential recession predictor. Normally, long-term rates are higher, reflecting expectations of future growth. An inversion suggests future economic slowdown as investors seek security in long-term bonds.

Yet, false alarms can occur; such inversions have happened without recessions. Market conditions and external economic factors need assessment to determine the inversion’s significance. Observing historical precedents may offer insights into possible outcomes of current yield curve behavior.

8. Retail sales figures provide insight into consumer spending habits.

Retail sales figures provide windows into consumer purchasing trends and overall economic activity. Increases in retail sales often indicate consumer confidence and prosperity, driving economic growth. Conversely, declining sales may suggest caution and potential economic slowdowns.

Interpreting these figures demands attention to specific sectors showing growth or decline, as seasonal effects and promotional activities can skew results temporarily. Analyzing data over several months offers broader understanding, revealing patterns vital for anticipation of broader economic trends.

9. Manufacturing output measures production levels across key industrial sectors.

Manufacturing output reflects production levels across various key sectors, offering insights into economic health. High outputs suggest robust industrial activity and strong demand, contributing to GDP growth. Declines might indicate economic contraction or shifts in production efficiency.

Different sectors may exhibit varied trends, necessitating consideration of broader economic forces. Technological advancements or shifts in global supply chains can influence manufacturing outputs and should be considered when evaluating future economic trajectories.

10. Business investment levels demonstrate confidence in future economic growth.

Business investment levels highlight confidence in economic prospects, as expansions typically follow anticipated growth. High investment indicates optimism about future returns, bolstering economic activity and innovation. A sudden drop might signal hesitation or economic uncertainties ahead.

Forecasting economic direction using business investment requires investigating underlying reasons for changes. Evaluate if fluctuations align with shifting market demands or external factors, like regulatory changes. Tracking investments in emerging technologies can shed light on potential future economic pathways.