Understanding luxury spending habits that build long-term financial value and savings.

Luxury spending often gets dismissed as wasteful, but some habits can actually save money over time by focusing on quality, durability, and thoughtful purchasing. Prioritizing investments that offer lasting value, such as timeless wardrobe pieces or energy-efficient appliances, helps reduce frequent replacements and utility costs. By budgeting for maintenance and avoiding impulse buys, these strategies promote financial discipline without sacrificing the benefits of luxury items.

1. Prioritize quality over quantity to reduce frequent replacement costs.

Luxury is not solely about splurging; quality can often outweigh quantity when it comes to savings. The tangible feel of a leather handbag versus its synthetic counterpart reveals this. A sturdy choice might save you repeat purchases, preserving your budget over time.

Cost-per-use calculations support this insight. A well-made bag, for instance, demands a high initial outlay but stands resilient over years, ultimately reducing frequent replacement needs. Understanding the long-term financial impact of such choices encourages a shift in spending patterns toward lasting value.

2. Invest in timeless wardrobe pieces that never go out of style.

Investing in timeless wardrobe staples offers a dual benefit: enduring style and financial efficiency. Classic items blend seamlessly with shifts in trend, reducing the need for constant updates. A neutral-tone trench coat serves as a perfect example, amplifying both function and fashion.

While trendy pieces may quickly lose appeal, timeless selections defy the passage of time, maintaining relevance across seasons. This approach not only curbs spending on fleeting fashions but also fosters a cohesive, interchangeable wardrobe that thrives through style transitions.

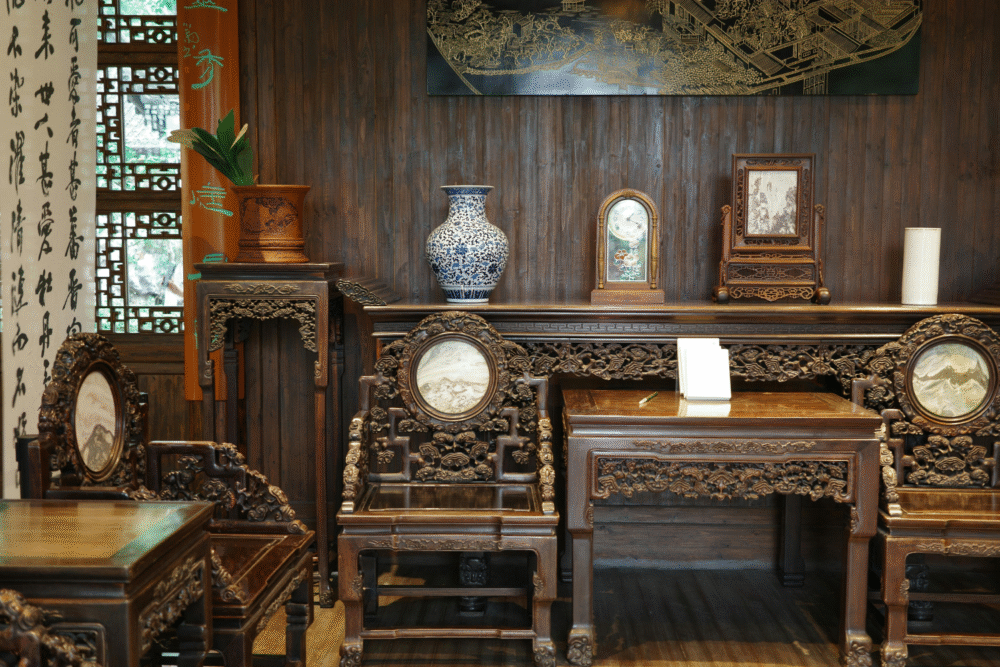

3. Choose durable home goods that withstand wear and tear gracefully.

Choosing durable home goods yields longevity and financial prudence. Solid wood furniture, for example, withstands life’s inevitable knocks. Its robust, natural texture adds an aesthetic appeal that lasts as trends ebb and flow, unlike cheaper materials that may soon crumble.

Durability minimizes the need for replacement while maintaining home aesthetics impressively. Well-chosen items become a fixture in your life, offering security and comfort without the lurking dread of constant repair or replacement, enriching both space and savings.

4. Opt for experiences that provide lasting memories rather than material items.

Opting for experiences over materials facilitates meaningful, lasting memories. A sunrise hot air balloon ride provides a vivid, unforgettable moment. Unlike material gifts that may gather dust, shared adventures build stories that are cherished long after the event is over.

Such choices impact well-being and bonding. Experiences foster connections and personal growth, often leading to greater overall satisfaction than physical goods. Over time, they contribute to a life narrative rich with unique chapters, rather than cluttered with forgotten collections.

5. Allocate budget for regular maintenance to extend product lifespan.

Budgeting for regular maintenance preserves the functionality and appearance of luxury items. It’s nurturing more than an object; it’s an investment in longevity. Consider the wheels of a classic car, ensuring dependable performance and a showroom shine through scheduled care.

Consistent upkeep might seem like an imposition, but it extends the object’s lifespan significantly. Such attention prevents costly repairs or replacements, ultimately safeguarding your initial investment—a practical case of protecting value by preserving form and function.

6. Focus on energy-efficient appliances to lower utility expenses steadily.

Energy-efficient appliances offer a path to monetary savings via reduced consumption. A refrigerator with an Energy Star rating lowers electricity use, quietly working to ease utility bills over time. The initial upfront cost hints at long-term financial and environmental returns.

As these appliances trim recurring expenses, they also shrink carbon footprints. The dual benefit merits thoughtful consideration, turning everyday tasks into a conscious act of conservation. Efficiency becomes a tangible contribution to both sustainability and fiscal responsibility.

7. Buy versatile items that serve multiple purposes in daily life.

Acquiring versatile items enhances life’s adaptability and value. Consider a convertible sofa bed transforming into a guest accommodation conditionally. Such practicality allows seamless space transitions while maximizing resource utilization.

Everyday life benefits from possessions serving multiple roles, eliminating the need for separate purchases. When items blend utility with ingenuity, they simplify living within finite spaces and budgets. This intelligent approach promotes efficiency, opening avenues for more purposeful spending instead.

8. Embrace minimalist spending by avoiding impulsive luxury purchases.

A minimalist approach curbs the impulse to splurge on luxury goods. Walking past a glittering store window, the urge to purchase can be intense. Restraint nurtures focus on essentials, minimizing buyer’s remorse and financial strain down the line.

Shifting focus from desire-driven decisions to deliberate choices empowers financial health. Concentrating on meaningful acquisitions, rather than fleeting whims, fosters a more manageable lifestyle and aligns spending with real needs, facilitating enduring peace of mind in fiscal conduct.