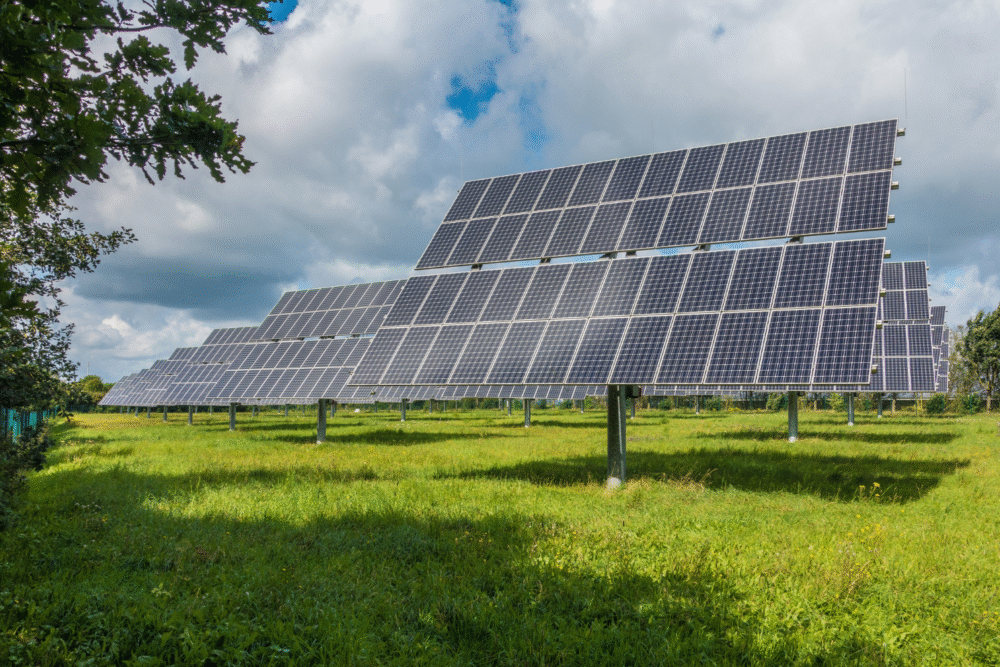

The quiet revolution happening on rooftops and desert landscapes could fundamentally reshape energy.

Solar energy has been dismissed for decades as too expensive, too intermittent, and too niche to matter. That narrative is collapsing faster than most people realize. Recent data shows solar installations are accelerating at rates that catch even optimistic forecasters off guard.

The technology improvements and cost reductions have reached a tipping point where solar doesn’t just compete with fossil fuels—it dominates them economically in most markets. What seemed impossible a decade ago now appears inevitable.

1. Solar installation costs have plummeted 90% since 2010, making it the cheapest electricity source in history.

The dramatic cost reduction in solar technology represents one of the fastest price declines for any energy source ever recorded. Utility-scale solar now costs around $0.03-0.04 per kilowatt-hour in ideal locations, undercutting coal, natural gas, and nuclear by significant margins. This isn’t about government subsidies anymore—solar wins on pure economics. Manufacturing improvements in China and economies of scale drove most of these savings.

Residential solar costs dropped even more dramatically when considering total system prices. A typical home installation that cost $40,000 in 2010 now runs around $15,000 before any tax credits. Financing options have evolved to eliminate upfront costs entirely for homeowners. The financial case has shifted so decisively that the question isn’t whether solar makes economic sense but rather why anyone would choose alternatives. Grid operators now prefer building new solar farms over maintaining existing fossil fuel plants purely based on operating costs.

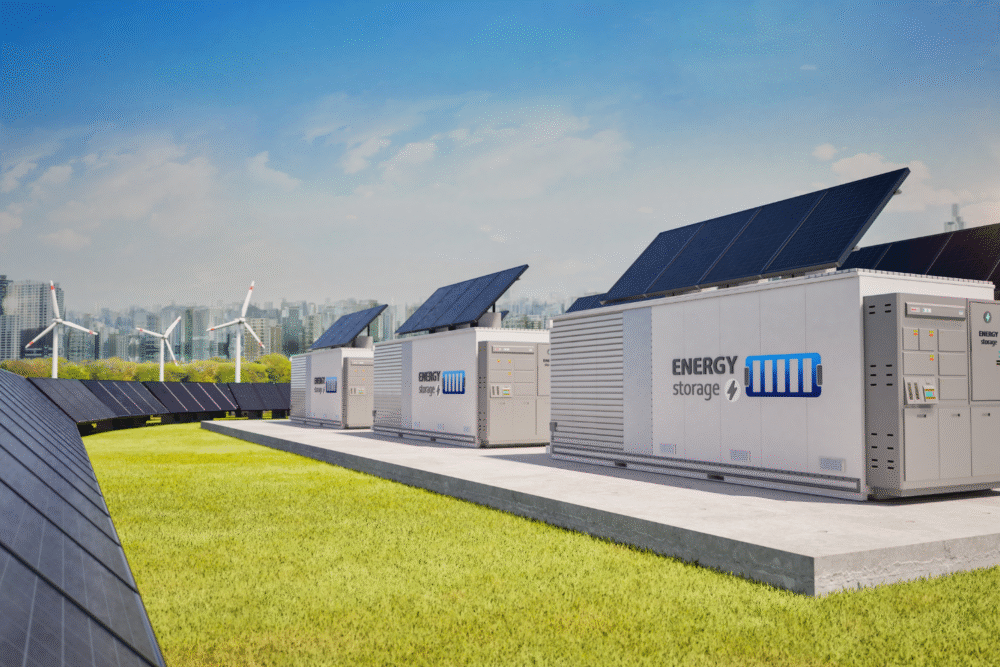

2. Battery storage technology has solved solar’s intermittency problem faster than experts predicted.

The longstanding criticism that solar can’t provide power at night has been effectively neutralized by rapid battery technology advances. Lithium-ion battery costs have fallen 89% since 2010, making grid-scale storage economically viable. California now regularly stores excess midday solar generation for evening peak demand. This wasn’t technically possible at scale just five years ago.

New installations increasingly pair solar panels with battery systems by default. Tesla, LG, and numerous Chinese manufacturers produce batteries specifically designed to absorb solar generation during the day and discharge during evening hours. Texas added more battery storage capacity in 2024 than the previous decade combined. The technology has advanced beyond merely storing for overnight use—modern systems can provide grid stabilization services that actually generate additional revenue. What was solar’s greatest weakness has transformed into a strength as fossil fuel plants struggle to ramp up and down to match variable demand patterns that battery systems handle effortlessly.

3. China’s manufacturing dominance has created a solar panel supply glut that benefits global adoption.

Chinese manufacturers now produce solar panels at such massive scale and low cost that they’ve fundamentally altered global energy economics. The country controls roughly 80% of worldwide solar manufacturing capacity. This concentration has driven prices down to levels that make solar installation profitable almost anywhere on Earth. Critics worry about supply chain dependencies, but the immediate result is unprecedented solar affordability.

The manufacturing overcapacity actually accelerates adoption curves in unexpected ways. Panels are so inexpensive that developers can afford less-than-ideal locations that would have been economically unviable just years ago. Cloudy regions, northern latitudes, and areas with less-than-perfect solar resources now host viable installations. This geographic expansion multiplies the total addressable market. European countries with relatively poor solar resources are installing capacity at record rates because the panels cost less than the mounting hardware. The economics have shifted so dramatically that even pessimistic solar forecasts from five years ago are being exceeded by 200-300% in many markets.

4. Utility companies are quietly shifting investments toward solar at unprecedented rates.

Traditional utility companies publicly express concerns about grid stability and renewable intermittency while privately racing to build solar capacity faster than any other generation type. Their actions reveal what their press releases obscure. Solar represented 53% of all new U.S. electricity generating capacity added in 2024. Natural gas accounted for most of the remainder, with coal adding exactly zero new capacity.

The shift reflects cold financial calculation rather than environmental commitment. Solar plants require minimal ongoing fuel costs and almost no operational staffing compared to fossil fuel alternatives. Utilities recognize that solar plus storage can now provide cheaper electricity than operating existing paid-off coal plants. Duke Energy, traditionally a coal and nuclear utility, now plans to add 30 gigawatts of solar by 2035. Southern Company, another fossil fuel stalwart, projects similar buildouts. These conversions happen quietly because utilities don’t want to alarm shareholders or provoke political backlash in conservative regions, but the infrastructure investment patterns tell the real story.

5. Residential solar adoption follows an exponential curve that mirrors early internet and smartphone uptake.

Rooftop solar installations exhibit classic technology adoption patterns seen previously with transformative innovations. Early adopters endured high costs and technical complications. As prices dropped and installation processes improved, mainstream adoption accelerated dramatically. Roughly 4% of U.S. homes now have solar panels. This might seem small, but adoption curves typically see explosive growth once penetration crosses 5-10% thresholds.

California leads with over 15% residential solar penetration, providing a preview of coming national trends. Neighbors installing solar panels significantly increases the likelihood of nearby homeowners following suit—the same peer influence effect that drove smartphone adoption. Solar companies now use sophisticated algorithms to target neighborhoods where one installation typically generates three to five additional sales within months. Financial products have evolved to eliminate barriers, with zero-down leases and power purchase agreements allowing homeowners to install solar with no upfront costs while immediately reducing electricity bills. The residential solar industry expects to reach 10 million installations by 2030, up from roughly 3.5 million today.

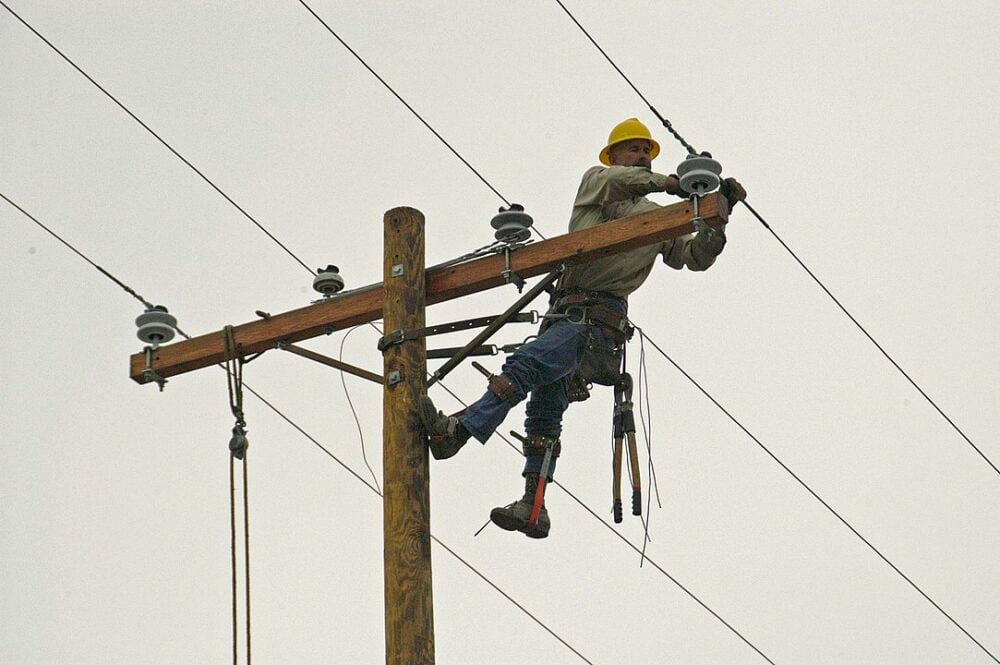

6. Grid infrastructure improvements designed for solar are creating unexpected benefits for overall system reliability.

Modernizing the electrical grid to accommodate distributed solar generation requires upgrades that improve reliability beyond just renewable integration. Smart inverters, advanced metering infrastructure, and sophisticated grid management software provide real-time visibility and control that legacy systems lacked. Texas discovered during recent storms that microgrids powered by solar and batteries maintained power to critical facilities when the main grid failed.

These improvements prove valuable even for non-solar applications. The same infrastructure that allows utilities to manage millions of rooftop solar installations enables better load balancing, faster outage detection, and more efficient power routing. California’s grid operators can now predict and respond to demand fluctuations in ways that were impossible with traditional centralized generation. The investments required to integrate solar are creating a fundamentally more capable and resilient grid architecture. Ironically, fossil fuel generators benefit from these improvements too, as better grid management allows more efficient utilization of all generation assets regardless of fuel source.

7. Corporate power purchase agreements for solar energy now exceed traditional utility procurement in many markets.

Major corporations have emerged as solar energy’s unexpected champions through direct power purchase agreements that bypass traditional utilities. Amazon, Google, Meta, and Microsoft now contract for more solar capacity than many utilities manage across their entire service territories. These tech giants need massive amounts of electricity for data centers and recognize that solar provides cost certainty that fossil fuels cannot match.

The corporate procurement trend is accelerating across industries beyond tech. Walmart has solar installations on thousands of store rooftops. General Motors committed to 100% renewable energy by 2035 and is building solar arrays at manufacturing facilities. These aren’t symbolic gestures—they’re financially motivated decisions by companies laser-focused on reducing operating expenses. Corporate solar contracts now provide more predictable revenue for developers than utility agreements in many cases. This shift in procurement power is restructuring the entire energy market, with corporations rather than utilities determining which projects get financed and built.

8. Developing nations are leapfrogging traditional grid infrastructure by building solar-first electrical systems.

Many developing countries are skipping the centralized fossil fuel power plant model entirely and building distributed solar microgrids instead. This mirrors how mobile phones allowed developing nations to bypass landline infrastructure. Rural India now has millions of homes powered by small solar installations that never connected to a central grid. The approach proves faster and cheaper than extending traditional grid infrastructure across vast distances.

Africa is experiencing similar patterns, with solar installations growing faster than any other form of electrification. The decentralized nature of solar allows communities to have power immediately rather than waiting years or decades for grid extensions that might never arrive. Companies like M-KOPA and d.light have created innovative financing models allowing impoverished households to acquire solar systems through mobile payment plans. These markets are adding solar capacity at rates that will soon exceed many developed nations in absolute terms. The developing world’s energy future increasingly looks solar-dominated by necessity and economics rather than environmental ideology.