Understanding shared ownership risks helps protect your finances and friendships in co-buying scenarios.

Co-buying a boat with a friend can seem like an affordable way to enjoy the water, but it carries distinct financial risks. Shared ownership means dividing not only the initial cost but also ongoing expenses like maintenance, insurance, and repairs. Without clear agreements or plans for disputes and exit strategies, potential conflicts can arise. Recognizing these risks upfront allows co-owners to make informed decisions and safeguard their investment and relationship.

1. Sharing unexpected maintenance costs can quickly strain your budget.

Boats require ongoing maintenance, and unforeseen repairs can emerge at any time. A brittle gasket gives way or the upholstery needs urgent replacement, and costs swiftly mount. In a shared ownership situation, agreeing on how to split these expenses can become complex.

Financial strain is a common outcome when unexpected maintenance outlays hit a shared budget. Without a pre-defined agreement on budget allocations, one partner may feel burdened by expenses, potentially straining both the friendship and financial relationship. Handling these issues thoughtfully from the outset is crucial.

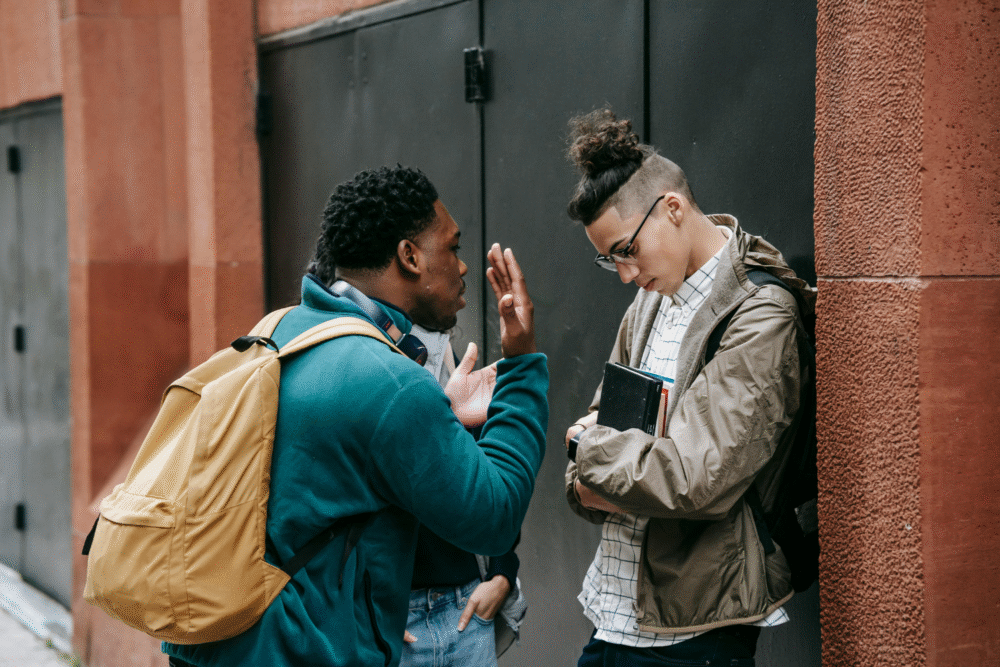

2. Disagreements over usage schedules often lead to tension and frustration.

Friends might start with the best intentions, but scheduling conflicts are common. Arranging who gets the boat on a sun-drenched Saturday morning can quickly become a headache. Such disagreements over usage schedules can lead to misunderstandings, especially in peak boating months.

To maintain harmony, co-owners must align expectations and respectschedules. When priorities clash, simmering frustration can spill over, adding tension to an arrangement meant to offer enjoyment. Balancing responsibilities with flexible agreements can ease these tensions.

3. Unequal contributions risk creating resentment and financial imbalance.

When co-owners contribute differently to a purchase, it can create an imbalance. One friend might cover a higher percentage of the cost, leading to potential friction. This discrepancy might seem manageable at first but often swells over time.

Resentment can develop if one person feels they’re shouldering more than their fair share of financial or maintenance duties. A precise financial split agreement can offset future discord. Clear communication about contributions sets the foundation for a more equitable ownership experience.

4. Selling the boat later may be complicated by joint ownership.

Selling a jointly-owned boat can be far from straightforward. Legal complexities abound due to shared ownership, requiring mutual consent to list the asset and settle discrepancies in valuation. This process can often become a cumbersome affair.

Dividing proceeds or resolving debts adds further intricacies. A well-defined exit strategy, crafted before purchase, can mitigate potential complications. Such foresight ensures smoother transitions if one owner seeks to move on, preserving both the friendship and investment.

5. Liability for damages increases when financial responsibility is shared.

Joint ownership extends the liability for damages beyond just shared cost duties. Accidents happen, like chips to the hull or a faulty anchor leading to beaching. These incidents often require rapid financial decisions.

When responsibility is shared, disputes over who covers what damages may arise. Clear agreements about financial liability can prevent an agreed-upon boat day from spiraling into unanticipated expenditure. Addressing these scenarios in advance not only protects finances but also shores up the partnership.

6. Differing priorities can result in costly disagreements about upgrades

Shared ownership brings forth differing visions for the boat’s upkeep and enhancements. While one partner dreams of a sleek added feature, the other may prioritize cost-efficiency. Disparate priorities can escalate into disputes over upgrades.

Catering to diverging tastes can lead to costly deadlocks unless consensus on upgrade planning is achieved. Establishing a framework for decision-making and budgeting can assist owners in maintaining a cohesive vision, averting potential financial or personal discord.

7. Insurance premiums might rise due to multiple owners on the policy.

Multiple owners on a boat insurance policy may lead to increased premiums. Insurers often assess risk based on the number of co-owners, perceiving more claim likelihood with more users. Such analysis drives up costs even if all co-owners are equally responsible.

Understanding how shared ownership impacts insurance requires attentive policy reviews. Using a comprehensive approach to identify and cover risks thoroughly can ensure that all parties are adequately protected. Awareness about these premium fluctuations can shelter co-owners from unwelcome surprises.