Younger generations are leveraging technology and habits to save more effectively than before.

Gen Z and Millennials are redefining saving money by using technology and mindful practices, setting them apart from older generations. Their financial habits often include automated saving, budgeting apps, and goal-oriented accounts, allowing for consistent growth in savings despite economic challenges. These strategies reflect a shift toward intentional money management, where clear goals and digital tools support healthier financial behavior over time.

1. Prioritize automatic transfers to savings accounts with each paycheck.

Automatic transfers to savings accounts streamline saving by eliminating manual steps. Each paycheck triggers a set amount to move directly into savings, creating consistency and reducing the temptation to spend. It’s an effortless mechanism that builds savings gradually without conscious effort.

Over time, this strategy fosters a sense of security as savings grow steadily. By seamlessly integrating this into their financial habits, young adults often find that their long-term goals become more tangible and achievable. A growing savings account might symbolize future desires, like travel or a first home.

2. Embrace budgeting apps to maintain clear oversight of expenses.

Budgeting apps offer real-time insight into spending, tracking every transaction to inform financial choices. With colorful graphs and intuitive interfaces, they turn abstract numbers into comprehensible data. By making invisible expenses visible, these apps empower users to adjust spending before it drifts beyond control.

Adopting this technology nurtures responsibility and awareness, as overspending triggers alerts. Young generations gain a daily snapshot of their spending habits, highlighting areas for improvement or celebration. As financial literacy grows, users feel more equipped to manage their money wisely.

3. Opt for cashless payments to better track daily spending habits.

Cashless payments streamline tracking, embedding financial awareness directly into daily life. Each digital transaction leaves a trail that budgeting apps can analyze, offering a precise portrayal of where money travels. It’s like having a financial journal that updates itself after every tap or swipe.

Over time, spending patterns become clear, with recurring expenses flagged for review. This transparency fosters better budget adherence, as seeing cumulative totals can encourage restraint. For many, the digital ledger becomes a trusted companion in the quest for mindful spending.

4. Separate savings into multiple accounts for specific goals and emergencies.

Different savings accounts cater to distinct goals or emergencies, providing clarity and focus. By designating funds for specific purposes, people can plan efficiently, knowing each dollar has a purpose. This compartmentalization helps avoid dipping into savings meant for urgent future needs.

Young savers often enjoy watching each account grow, each milestone charting progress toward a dream or safety net. Whether it’s a wedding, a vacation, or a rainy day fund, clear boundaries facilitate disciplined saving. The satisfaction lies in knowing financial stability is within reach.

5. Limit impulse buying by instituting a 24-hour pause before purchases.

A 24-hour pause before purchases curbs impulse buys, encouraging reflection over instant gratification. Waiting allows time to reconsider necessity and value, preventing regret. By transforming impulsivity into deliberation, unnecessary expenses are avoided, and savings potential increases.

This breathing space often reveals that the spark behind an impulse purchase fades with time. The pause protects budgets from impulsive dents that quickly add up, especially concerning non-essential items. Such habits cultivate financial discipline, making each purchase a conscious choice rather than a fleeting decision.

6. Consistently review and adjust subscription services to avoid unnecessary costs.

Regularly reviewing subscriptions prevents hidden expenses from accumulating. Many discover forgotten services silently siphoning money due to renewed subscriptions. By evaluating each one’s relevance, it’s easier to cut redundant or underutilized ones, freeing up funds for savings.

Cultivating this practice ensures that only valuable subscriptions remain, each contributing positively to daily life. Young adults who apply this scrutiny often uncover surprising savings, which can be redirected to other financial priorities. It’s a simple yet powerful technique for maintaining budgetary balance.

7. Favor experiences and quality over quantity to reduce frivolous expenses.

Prioritizing experiences and quality over sheer quantity reshapes spending habits. Opting for lasting enjoyment or durable items ensures money is spent wisely, enriching personal life meaningfully. This mindfulness contrasts with the disposable culture that leads to clutter and fleeting satisfaction.

For many, genuine fulfillment arises from memorable experiences or well-crafted possessions. By fostering thoughtful consumption, financial resources are preserved, and life’s quality improves. This approach anchors spending in lasting memories or enduring items, enhancing both budget health and personal happiness.

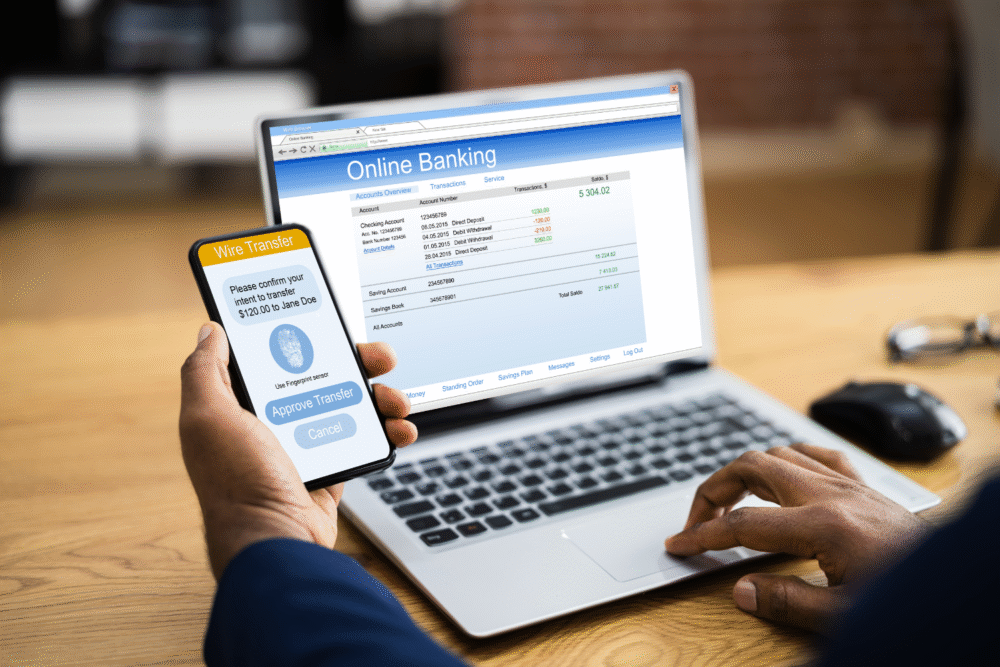

8. Use digital tools to set and monitor short- and long-term savings targets.

Digital tools for setting savings targets offer precision and motivation. Goals can be broken into manageable chunks, with visual progress tracking encouraging persistence. By linking short- and long-term objectives, these tools guide financial behaviors, creating a coherent plan for growth.

As aims are defined, progress feels tangible, motivating further commitment. This clarity fosters confidence, ensuring that each saving decision aligns with overarching financial aspirations. The digital assistance serves as a reassuring constant, turning abstract goals into landmarks of progress.

9. Prioritize paying off high-interest debts to free up more saving capacity.

Paying off high-interest debts takes precedence, as interest eats into potential savings. By eliminating these burdens early, the freed-up funds enlarge future savings capacity. Prioritizing debt reduction reduces financial anxiety, lifting weights that impede budget planning and flexibility.

With debt conquered, more income can nurture savings, creating breathing room within budgets. This relief transforms financial horizons, as interest payments cease to stifle future growth. By integrating this into money management strategies, financial wellness is more attainable.

10. Seek out student discounts and loyalty programs to maximize everyday savings.

Student discounts and loyalty programs facilitate everyday savings, often overlooked in regular transactions. By identifying discounts or rewards, expenditures stretch further, providing financial relief in daily spending. It’s an efficient way to enhance savings without altering habits significantly.

Access to such programs helps strike a balance between necessary purchases and budget constraints. As discounts accumulate, so do opportunities to allocate more toward savings. This understated strategy enhances financial well-being within regular routines, quietly fortifying financial resilience.

11. Cultivate mindful consumption habits that align with personal financial goals.

Mindful consumption aligns spending with personal values, curbing waste and maximizing utility. It’s a practice of reflecting on whether purchases genuinely enhance life, fostering aligned, conscious financial habits. In a society nudging constant acquisition, this practice cultivates clarity and purpose.

For many, it means recalibrating lifestyle choices to reflect deeper intentions. This reflection reduces superfluous purchases, injecting meaning into every transaction. As spending aligns with core values, both satisfaction and savings rise, intertwining financial decisions with personal well-being.

12. Communicate openly about money matters with peers for shared accountability.

Open communication about money with peers builds transparency and accountability. Sharing goals and setbacks creates a support system, normalizing financial discussions that often carry stigma. It’s a step toward cultivating better awareness and responsibility among friends.

Over time, these conversations enrich personal finance skills, easing financial burdens through shared knowledge. Discussing money openly dispels myths and reduces financial pressure, creating an environment where shared advice benefits collective financial growth. Such dialogues fortify communal support around money management.