It’s not your father’s brokerage, and that’s entirely the point.

The world of investing your parents grew up in was a deliberate and formal affair, a place of hushed phone calls to a trusted stockbroker and quarterly paper statements arriving in the mail. It was a system built on a foundation of long-term planning, professional guidance, and a healthy dose of skepticism toward anything that seemed too fast or too easy.

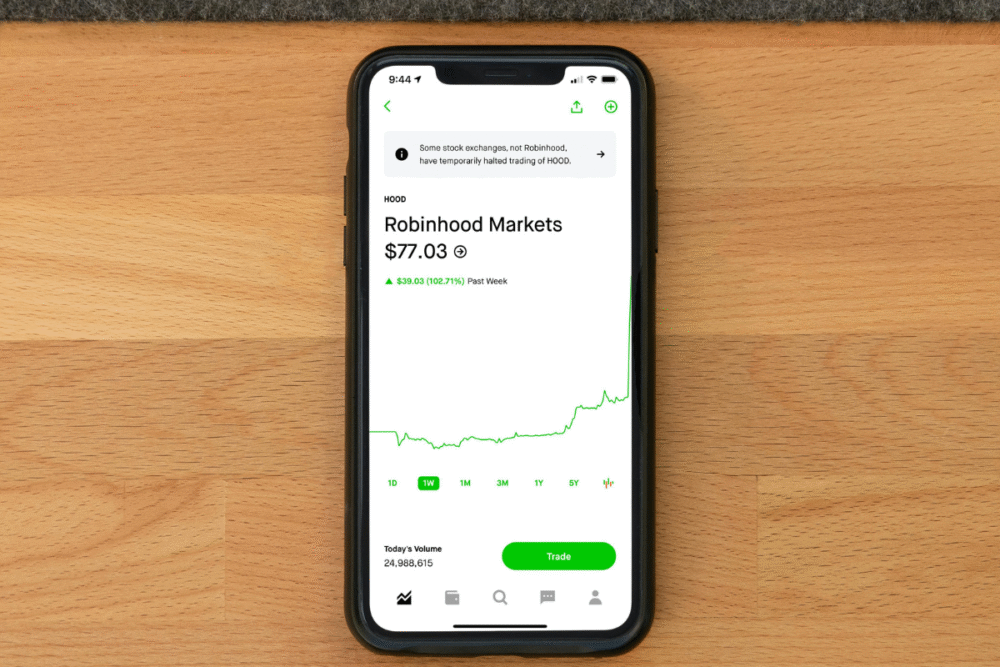

Robinhood, in its very essence, is a direct and unapologetic rejection of that entire paradigm. The app is a product of a different era, built for a different mindset, and its core features and design philosophy are often fundamentally at odds with the cautious, hands-off approach favored by previous generations.

1. The platform prioritizes the mobile app above all else.

For a traditional investor, the desktop platform is mission control. It’s where they conduct deep research, analyze complex charts, and manage their portfolio across multiple large screens. Robinhood, by contrast, treats its desktop version as a secondary thought. The primary, feature-complete experience is, and always has been, the mobile app.

This mobile-first approach is perfect for a quick trade while waiting in line for coffee, but it feels limiting and insufficient to an investor who is accustomed to a more robust, data-rich desktop environment. It signals a clear focus on on-the-go access over deep, seated analysis, a trade-off many older investors are unwilling to make.

2. The focus is on individual stocks and crypto, not mutual funds.

The cornerstone of a traditional, diversified retirement portfolio is often the humble mutual fund, a professionally managed basket of stocks and bonds. While you can buy ETFs on Robinhood, the platform’s entire design and discovery features are geared toward the excitement of trading individual stocks, options, and cryptocurrencies. Mutual funds are not even offered on the platform.

This focus on more speculative, high-volatility assets can be a major red flag for a conservative, buy-and-hold investor. They are looking for slow, steady, professionally managed growth, not the wild price swings and high risks associated with picking individual stocks or trading crypto.

3. There are no human financial advisors to call for advice.

When your parents had a question about their portfolio or a concern about market volatility, they could pick up the phone and speak to their dedicated financial advisor or stockbroker. This human element provided a crucial layer of guidance, reassurance, and personalized advice. Robinhood, by design, has completely removed this human intermediary from the equation.

The platform is a self-service tool, and there is no one to call for a professional opinion on whether a particular stock is a good fit for your long-term goals. For an investor who values and relies on professional guidance, this lack of human support is a complete non-starter.

4. The design encourages more active trading by its very nature.

Everything about the Robinhood app, from the real-time price charts to the list of “Top Movers,” is designed to encourage activity. It presents the stock market as a dynamic, exciting game that you should be actively playing. This can be engaging, but it’s the polar opposite of the passive, set-it-and-forget-it investing style that many older investors have successfully used for decades.

A traditional investor might check their portfolio once a quarter. The Robinhood app, with its constant updates and notifications, implicitly encourages you to check it multiple times a day. This focus on short-term market movements is fundamentally at odds with a long-term, passive investment philosophy.

5. The research tools are intentionally simplified.

A traditional brokerage platform like Charles Schwab or Fidelity offers a vast arsenal of sophisticated research tools, including deep fundamental analysis, third-party analyst reports, and advanced charting capabilities. Robinhood, in its quest for simplicity, offers a much more streamlined and basic set of research tools. While it has integrated some professional research for its Gold members, it’s still limited.

For a parent who was taught to “do their homework” by poring over financial statements and analyst ratings, Robinhood’s offering can feel woefully inadequate. It prioritizes ease of use over depth of information, a design choice that doesn’t sit well with research-heavy investors.

6. Customer service is primarily digital and not phone-based.

If you have a problem with your account at a legacy brokerage, the standard procedure is to call a customer service number and speak to a human being. Robinhood’s customer service model, however, is built around a digital-first approach, relying heavily on in-app chat support and email. While they have added more phone support, it’s not the primary channel.

For a generation that is accustomed to resolving issues through a direct phone conversation, this digital-first model can be incredibly frustrating. It can feel impersonal and inefficient, especially when dealing with a complex or urgent financial issue where you just want to talk to a person.

7. It lacks the comprehensive retirement planning tools they expect.

Older investors are typically focused on a specific goal: a comfortable retirement. Legacy brokerage websites are packed with tools designed for this purpose, such as retirement calculators, portfolio allocation models, and detailed information on different types of IRAs and 401(k) rollovers. Robinhood’s retirement offerings are newer and less comprehensive.

While Robinhood has made strides by offering an IRA with a company match, its platform still lacks the holistic, goal-oriented planning tools that are standard at more traditional firms. It’s built more for the accumulation phase of investing, not the complex planning and decumulation phases of retirement.

8. The app is geared toward discovery, not long-term strategy.

Robinhood excels at helping you discover what is popular and trending in the market right now. Its lists of the most-held stocks and its integration with social sentiment are designed to surface new and exciting trading ideas. This is a powerful engine for engagement, but it’s not conducive to building a disciplined, long-term investment strategy.

Your parents’ investing style is likely based on a predefined asset allocation and a commitment to stick with it through market ups and downs, not on chasing the hot stock of the week. The discovery-focused nature of the app runs counter to this disciplined, strategic approach.