The quiet luxuries that devour a future of ease.

In the grand narrative of personal finance, we often fixate on the seismic events—market crashes, career changes, windfalls—while ignoring the subtle, daily erosion of our future wealth. The slow, relentless drip of seemingly minor expenditures has a far more profound impact than we care to admit, quietly rerouting a fortune from our retirement accounts into the coffers of convenience.

These are not sins of extravagance but habits of modern life, the small comforts and minor upgrades that have become normalized. Yet, it is within these mundane transactions that the difference between a comfortable retirement and a strained one is often decided, one five-dollar coffee and one unwatched subscription at a time.

1. The daily artisanal coffee is a classic wealth drain.

That daily trip to the chic café for a perfectly crafted latte feels like a small, essential ritual, a permissible indulgence in a demanding world. Yet, this habit represents one of the most significant financial leaks for many professionals. A $6 coffee five days a week adds up to over $1,500 a year, a sum that, if invested over a career, could blossom into a staggering amount of money, potentially tens of thousands of dollars.

This isn’t about depriving yourself of good coffee; it’s about recognizing the enormous long-term cost of outsourced convenience. Investing in a quality home espresso machine and premium beans can provide the same ritual and quality for a fraction of the cost. The money saved isn’t just spare change; it’s a direct and substantial contribution to your future financial freedom.

2. Curated subscription boxes deliver expensive clutter.

The allure of a subscription box is the promise of delightful discovery, a curated package of goodies arriving at your doorstep like a monthly gift to yourself. Whether it’s for grooming products, exotic snacks, or geeky paraphernalia, these services excel at marketing a lifestyle. The problem is that they often deliver items you would never have purchased independently, creating expensive clutter under the guise of curation.

For a recurring fee, you are essentially paying for the surprise, not necessarily the utility. A quick audit of these subscriptions often reveals a trail of unused products and a steady drain on your bank account for things you simply don’t need. Canceling them and buying only what you truly want is an immediate way to reclaim hundreds of dollars per year.

3. The annual smartphone upgrade is a marketing trap.

Technology companies have mastered the art of creating manufactured desire, unveiling a new flagship phone each year with incremental improvements presented as revolutionary leaps. The pressure to have the latest model is a powerful social and marketing force, compelling millions to trade in perfectly functional devices for the newest status symbol. This cycle is an incredibly expensive habit that serves the company’s shareholders, not your retirement fund.

Resisting this upgrade cycle and keeping your phone for three, four, or even five years can save you thousands of dollars. The functional difference between last year’s model and this year’s is often negligible for the average user. Opting out of this marketing-driven hamster wheel is a powerful move to redirect significant cash toward your long-term goals.

4. Designer clothing bought at full price is a fool’s errand.

There is a distinct thrill that comes with purchasing a brand-new, full-price item from a luxury designer. It feels like an anointment, an entry into a more exclusive world. However, this feeling comes with an astronomical and unnecessary markup. High-end fashion is an industry built on rapid depreciation, and an item’s value plummets the moment you walk out of the store with it.

Smart shoppers with a taste for luxury understand this. They buy classic, timeless pieces, often from consignment stores, sample sales, or during end-of-season clearances, paying a fraction of the original price. Paying the full retail price for a trendy designer piece is one of the fastest ways to turn a large amount of money into a much smaller one.

5. Overpriced gym memberships go largely unused.

The intention behind a gym membership is always noble, a commitment to health and well-being. The reality, however, is that many high-end fitness clubs function as aspirational subscriptions. People sign up for the state-of-the-art facilities, the eucalyptus-scented towels, and the sense of community, yet their attendance record tells a story of wasted money. A contract for $150 a month is a stealth wealth destroyer if you only go twice.

A more financially prudent approach is to pay for fitness as you use it, through class packs at a yoga studio or by finding more affordable, less glamorous gym options. Even better, exploring the world of home workouts or outdoor activities like running and cycling can provide the same health benefits for a fraction of the cost, eliminating a significant monthly expense.

6. Food delivery services trade wealth for convenience.

The seamless magic of summoning a hot meal to your doorstep with a few taps on your phone has become a modern addiction. While undeniably convenient, the heavy reliance on services like DoorDash and Uber Eats is a financial catastrophe in slow motion. The combination of service fees, delivery charges, driver tips, and inflated menu prices means you are often paying double what the meal would cost otherwise.

This habit is a direct tax on exhaustion and poor planning. The cumulative effect of ordering in several times a week can easily siphon hundreds of dollars from your budget each month. Learning a few simple, quick recipes or embracing meal prepping can break this cycle, redirecting a substantial amount of money from fleeting convenience to lasting wealth.

7. Buying bottled water is a senseless expense.

The notion that you need to purchase water in disposable plastic bottles is one of the great marketing triumphs of the modern era. In most developed areas, the tap water is perfectly safe and regulated, yet consumers spend billions of dollars a year on a product that is, for all intents and purposes, free. It is a textbook example of paying a premium for something you don’t need.

The environmental cost is staggering, but the financial one is just as absurd. Investing a small amount in a quality water filter pitcher or a reusable bottle provides the same, if not better, quality of water for a tiny fraction of the cost. Eliminating bottled water from your shopping list is a simple, immediate change that stops you from literally throwing money away.

8. Premium cable packages are a relic of the past.

In the age of à la carte streaming, the traditional, all-inclusive cable package is an increasingly unjustifiable expense. Many households pay upward of $100 a month for a bundle that includes hundreds of channels they never watch, from sports leagues they don’t follow to news networks they actively avoid. It’s a bloated, outdated model that forces you to pay for an abundance of unwanted content.

A careful audit of your viewing habits usually reveals that a handful of streaming services can provide all the entertainment you actually consume for less than half the price. Cutting the cord and subscribing only to the platforms you value is a straightforward money-saving move that can free up over a thousand dollars a year for more important financial goals.

9. A brand-new car is a depreciating anchor on your finances.

Few financial decisions are as damaging to wealth creation as the purchase of a brand-new car. The allure of that new-car smell and the latest technology is powerful, but it comes at an immense cost. A new vehicle loses a significant portion of its value—often as much as 20%—the moment you drive it off the lot. It is a massive, immediate, and guaranteed investment loss.

Opting for a reliable, two-to-three-year-old used car allows someone else to absorb that initial, brutal wave of depreciation. You get a vehicle that is nearly as good, for a price that is substantially lower. This single decision can save you tens of thousands of dollars in purchase price and lower your monthly payments and insurance costs, freeing up immense capital for investment.

10. Lottery tickets are a tax on false hope.

The fantasy sold by state lotteries is intoxicating: a small investment for a chance at a life of unimaginable wealth. In reality, purchasing lottery tickets is nothing more than a voluntary tax on people who are bad at math. The odds of winning a major jackpot are infinitesimally small, making it one of the worst possible uses for your money from a statistical standpoint.

That “harmless” few dollars spent on tickets each week adds up over time, representing money that could have been put to productive use. It’s a habit that preys on a desire for a magic bullet to solve financial problems, while actively making them worse. Redirecting that money into a savings or investment account guarantees a return, unlike the near-guaranteed loss of the lottery.

11. Fast fashion provides a wardrobe with no value.

The thrill of a fast-fashion haul—emerging from a store like Zara or H&M with bags of trendy, inexpensive clothes—is fleeting. These garments are designed to be disposable, created to capitalize on micro-trends and fall apart after a few washes. This creates a perpetual cycle of buying, wearing, and discarding, which is not only environmentally disastrous but also a constant drain on your finances.

Investing in fewer, higher-quality, timeless pieces of clothing is a far more economically sound strategy. A well-made garment will last for years, ultimately costing you less per wear than a dozen cheap, trendy items. It requires shifting your mindset from chasing fleeting trends to building a lasting, valuable wardrobe.

12. Unused streaming subscriptions are silent money pits.

The “subscribe and forget” phenomenon is a major profit center for digital media companies. Many of us sign up for a free trial of a streaming service to watch a single show and then neglect to cancel it. The small, recurring monthly charge is easy to overlook, but these forgotten subscriptions can add up to a significant annual expense for content you are not consuming.

A quarterly audit of your bank or credit card statements is essential to hunt down and eliminate these parasitic charges. Being ruthless about canceling services you no longer use is a simple act of financial hygiene. It ensures you are only paying for the media you actively enjoy, plugging a common and often invisible leak in your budget.

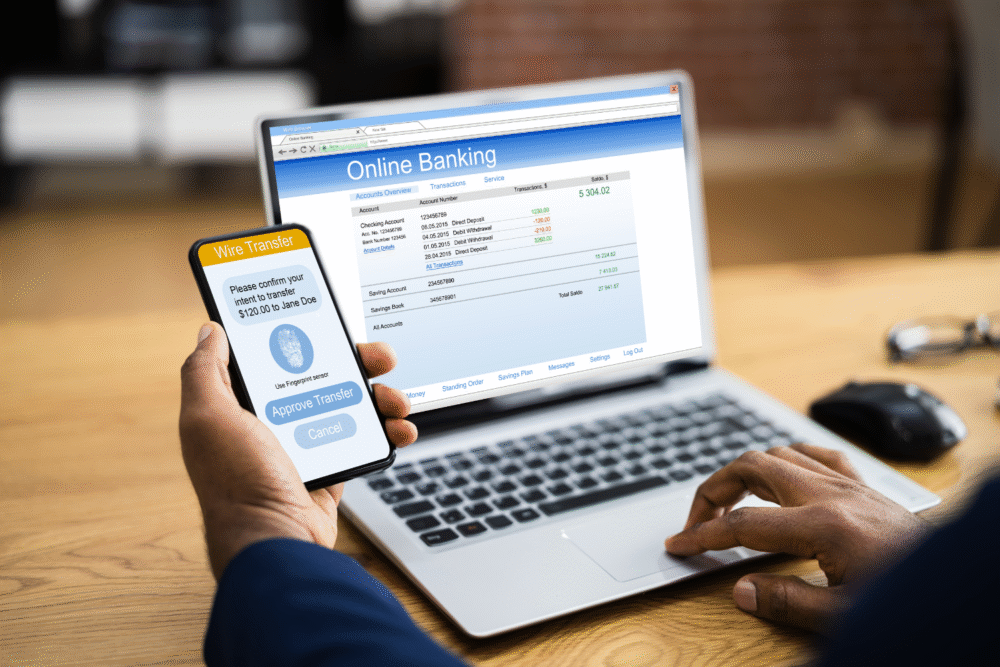

13. Paying bank fees is completely avoidable.

Bank fees, such as monthly maintenance charges for falling below a minimum balance or fees for using an out-of-network ATM, are entirely unnecessary expenses. You are essentially paying a penalty for not adhering to the bank’s preferred way of doing business. In a competitive financial marketplace, there is absolutely no reason to stay with an institution that charges you for the privilege of holding your money.

Switching to a modern online bank or a local credit union can often eliminate these fees entirely. These institutions typically offer free checking accounts with no minimum balance requirements and may even reimburse ATM fees. Refusing to pay bank fees is a simple matter of choosing the right product and keeping more of your own money.