Learn how classic Monopoly strategies like negotiation and cash flow management apply directly to real-life planning.

Monopoly may look like just a rainy-day pastime, but it’s actually a crash course in real-world decision-making. The game pushes players to weigh risks, manage limited resources, negotiate deals, and think long-term—skills that echo far beyond the board. Research in behavioral economics shows that games like Monopoly can mirror strategic thinking used in finance, career planning, and even relationships. With every dice roll, you’re not only trying to win the game—you’re practicing strategies for life itself.

1. Focus on acquiring properties in high-traffic areas early in the game.

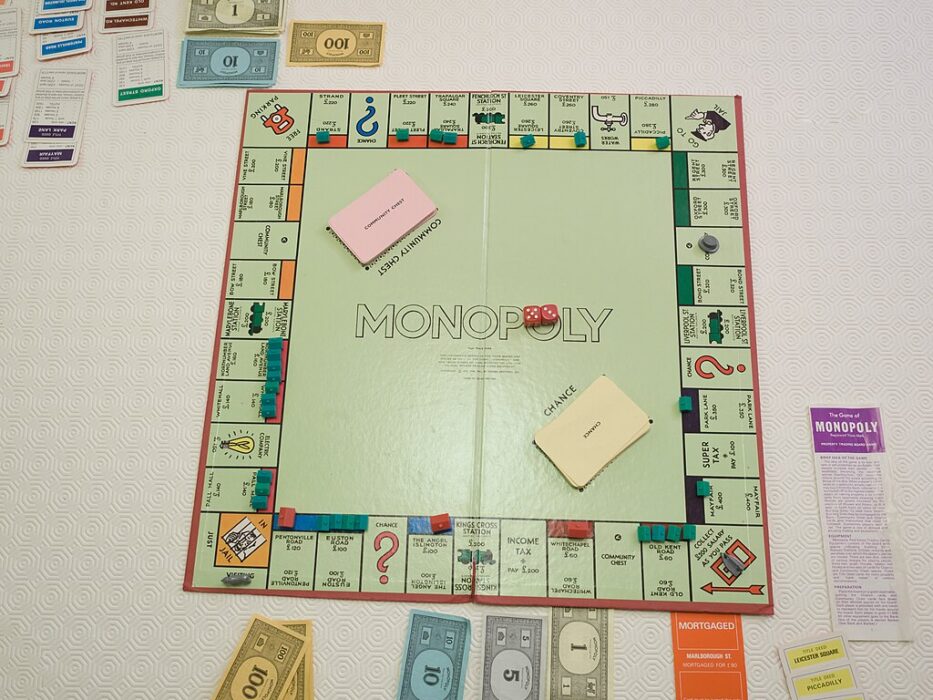

Acquiring properties in high traffic areas early means prioritizing locations that see the most movement and transactions within the game. These spaces tend to generate steady rent income because other players land on them more often, and owning them increases your bargaining power when trading. Think of property acquisition as a way to capture recurring value rather than chasing occasional windfalls. Identifying those high-traffic spots relies on understanding board flow and probability of landing, which guides where to invest limited early resources for the best long term return.

Owning busy properties boosts steady income and creates leverage in future trades, so aim to secure one or two such assets fast. A practical tip is to follow the crowd for three turns and note which squares get the most landings, then prioritize buying at least one of those early. Maintain a small emergency cash buffer equal to two to three regular rents to avoid forced sales. Consult a qualified professional for personalized financial planning if applying this approach to real world investments.

2. Trade wisely to complete color sets and increase your building potential.

Trading to complete color sets increases your building potential by enabling house and hotel development on grouped properties. A full set raises rent dramatically and converts scattered holdings into scalable income sources. The mechanic relies on swapping complementary assets with other players and assessing offers based on future earning potential rather than immediate gain. Efficient trades balance fairness and leverage, turning mid game negotiating into a sustained advantage that outperforms one time payouts. Understanding opportunity cost helps decide when to accept a trade and when to hold for a stronger position.

Completing sets accelerates growth and compounds returns, so prioritize trades that unlock construction potential. A useful checklist step is to accept trades that increase your projected rent by at least 50 percent within three turns. Keep one tradeable asset as negotiation currency to avoid being stuck. For major financial choices in life use a professional adviser to align trades with broader goals.

3. Manage your cash flow carefully to survive unexpected expenses and opportunities.

Managing cash flow carefully means tracking incoming rents, outgoing payments, and maintaining liquidity for unexpected demands. Cash flow management prevents forced asset sales when you need to cover penalties, maintenance, or sudden opportunities. It involves forecasting short term expenses and setting aside reserves so you can handle fines or buy key properties when they appear. Good management balances reinvestment with safety by avoiding tying up every resource in illiquid assets, and by planning for the random events that characterize both the game and real world finances.

A steady cash buffer reduces stress and preserves options, so keep liquid reserves before making big purchases. A practical rule of thumb is to retain funds equal to three times typical rent obligations or likely penalties. Update your forecast after each major move and avoid tapping reserves for low value upgrades. Consult a qualified professional for personalized advice on cash flow strategies in larger financial contexts.

4. Invest in houses and hotels strategically to maximize rental income.

Investing in houses and hotels is about converting ownership into recurring, higher value returns through upgrades. In Monopoly terms buildings multiply rent on a property set, creating a step change in income that pressures opponents and accelerates your wealth accumulation. The trick is timing and placement, choosing which sets to upgrade first based on traffic and cost of development. Overbuilding on low traffic streets wastes capital, while targeted upgrades on busy sets maximize impact. Treatment of upgrading as an investment decision rather than a vanity metric leads to better resource management and higher net gains over time.

Well timed improvements can choke opponents and secure dominance, so prioritize upgrades that yield the biggest rent increase per dollar spent. A concrete tip is to calculate rent per upgrade cost and target sets with the highest ratio. Keep enough liquidity to survive a few unlucky turns after upgrading. If considering similar moves outside the game consult a qualified professional for tailored investment guidance.

5. Monitor opponents’ moves and anticipate their strategies to stay ahead.

Monitoring opponents means observing their purchases, cash positions, and trading behavior to infer their intentions and constraints. Anticipation arises from pattern recognition and note taking, such as who is collecting a color, who hoards cash, and who is willing to trade. This strategic awareness transforms reactive play into proactive moves, allowing you to block critical acquisitions or set up trades that shape the board. It also includes risk assessment of opponents achieving certain milestones and adjusting your own plans to counter or exploit those paths.

Using opponent insights helps you avoid surprises and seize opportunities faster, so make monitoring part of every turn. A practical checklist step is to mentally track two players you think pose the biggest threat and reassess that list after each full rotation. Avoid overcommitment to perfect prediction and keep flexible options. For significant strategic decisions in life consider professional consultation to combine observations with expert analysis.

6. Use negotiation skills to make mutually beneficial deals with other players.

Using negotiation skills means crafting offers that appeal to both parties and trading with strategic clarity and fairness. Effective negotiation skills combine clear communication, willingness to compromise, and understanding other players motives such as cash needs or set completion. Skilled negotiators frame deals to highlight mutual benefit and use timing to increase leverage, for instance proposing trades when the other party faces a tight cash situation. Developing these skills in the game helps refine persuasion, active listening, and deal structuring that transfer to real world interactions and collaborative problem solving.

Good negotiation produces win win outcomes and preserves relationships, so aim to propose trades that improve both sides positions. A concrete tip is to state the key benefit for the other party first and then present your ask, making reciprocal value explicit. Keep a fallback offer to avoid deadlocks and protect your core assets. For complex personal or business negotiations seek professional advice tailored to your circumstances.

7. Avoid overextending financially by balancing investments and liquid assets.

Avoiding financial overextension means balancing investments and liquid assets rather than committing everything to high reward but illiquid options. Overextension happens when one concentrates resources in one area and cannot meet short term obligations or capitalize on emergent opportunities. It requires disciplined risk assessment and portfolio thinking, including asset diversification and staged commitments. Recognizing the trade off between growth and flexibility helps you construct plans that withstand shocks and allow course correction, reducing the likelihood of forced asset liquidation under pressure.

Maintaining balance preserves optionality and reduces stress in uncertain situations, so set caps on how much you invest at once. A practical tip is to never deploy more than 70 percent of available capital into fixed, non liquid investments. Periodically review your exposure and rebalance toward liquidity after major changes. For major financial decisions consult a qualified professional to align risk tolerance with long term goals.

8. Understand the value of patience when waiting for the right investment moment.

Understanding the value of patience involves recognizing that some opportunities yield higher returns if you wait for the right moment to invest or negotiate. Strategic patience emphasizes long term planning, delaying gratification for greater gains, and avoiding impulsive trades that offer immediate but small benefits. Opportunity cost plays a key role by comparing what you give up now against potential future advantages. Practicing patience teaches you to assess timing, monitor market signals, and choose moments where the odds and payoffs align more favorably with your investment strategy.

Patience often separates consistent winners from impulsive players, so delay non urgent moves until conditions improve. A practical step is to wait at least one full rotation of play after a major market shift before making irreversible investments. Keep a short term contingency fund to avoid panic decisions. If translating this mindset to big life choices consider consulting a qualified professional for personalized timing strategies.

9. Adapt your strategy based on the game’s evolving dynamics and player behavior.

Adapting strategy means adjusting plans based on the game state and other players behavior instead of rigidly following a single approach. It includes reassessing asset diversification, shifting from aggressive acquisition to defensive cash management, or changing negotiation tactics as opponents evolve. Flexibility requires ongoing monitoring, quick risk assessment, and readiness to pivot when an opportunity or threat emerges. It also involves learning from past moves and anticipating how your choices influence others, so adaptation blends situational awareness with long term planning and resource management.

Being adaptable helps you exploit shifting dynamics and avoid costly mistakes, so review your plan after each cycle and update priorities. A practical checklist step is to list three contingency actions for common scenarios such as a rival completing a set or running low on cash. Ensure you preserve enough liquidity to enact pivots. For complex adaptations in life seek professional advice to coordinate changes with broader objectives.