The normalization of debt for daily bread is a dangerous financial frontier.

In the ever-expanding universe of consumer credit, a new and unsettling frontier has opened: your grocery aisle. The Buy Now, Pay Later (BNPL) services that first took root in fashion and electronics have now crept into the most essential category of human spending. The ability to split the cost of your milk, eggs, and bread into four interest-free payments is being marketed as a flexible, modern way to manage your cash flow.

But this convenience masks a perilous financial trap. The application of installment debt to everyday consumables—items that are gone long before they are paid for—is a fundamental shift in our relationship with money. It’s a practice that encourages poor financial habits and can quickly spiral into a cycle of debt for those who can least afford it.

1. It completely disconnects you from the real cost of food.

When you pay for your groceries with a debit card or cash, you feel the immediate financial impact of your choices. A $200 grocery bill feels like a $200 expense. When a BNPL service offers to turn that into four “easy” payments of $50, it psychologically tricks you into feeling like the groceries are cheaper than they actually are.

This disconnect makes it much harder to budget effectively and to make conscious spending decisions. It anesthetizes the financial pain of a large grocery bill, which is a crucial feedback mechanism for keeping your spending in check. You end up making purchasing decisions based on the small installment payment, not the total cost.

2. You are financing an asset that has zero future value.

Using an installment loan to buy a long-lasting asset like a couch or a laptop can sometimes be a justifiable financial decision. That asset has a useful life that extends beyond the payment period. Groceries, on the other hand, are the ultimate consumable. The food you buy today will be gone in a matter of days or weeks.

Using BNPL for groceries means you could still be making payments in October for a pizza you ate in September. You are going into debt for something that has already been consumed and has no resale or residual value. This is a fundamental violation of sound financial principles and a fast track to owing money for nothing.

3. It is a powerful encouragement to overspend at the checkout.

The primary business goal of a BNPL provider is to increase conversion rates and average order values for their retail partners. When you know you can split the cost, you are far more likely to add extra, non-essential items to your cart. That artisanal cheese, the expensive snacks, and the premium cuts of meat seem much more affordable when you’re only thinking about the first small payment.

This leads directly to budget overruns and impulse spending. BNPL turns a trip for essential groceries into a tempting opportunity to splurge, pushing your total bill higher than it would have been if you were paying the full amount upfront.

4. The late fees can be severe and disproportionate.

While the main selling point of most BNPL services is the “interest-free” nature of the payments, their business model heavily relies on collecting high fees from customers who miss a payment. A single missed installment can trigger a late fee that, when calculated as a percentage of that small payment, represents an astronomically high effective interest rate.

For someone who is already struggling to afford groceries, a late fee can be the trigger that begins a downward spiral. It adds an extra financial burden to an already tight budget, making it even harder to catch up on future payments and other essential bills.

5. It creates a confusing web of overlapping payments.

A single BNPL plan for a single purchase can be easy to track. But if you start using it for your weekly grocery shopping, you will quickly find yourself managing a confusing web of multiple, overlapping payment schedules. You might have a payment due every few days, each tied to a different grocery run, making it incredibly difficult to manage your cash flow.

This complexity significantly increases the risk that you will accidentally miss a payment simply because you lost track of which installment was due on which day. This creates unnecessary stress and increases your likelihood of incurring late fees.

6. You could still be paying for food you threw away.

Food waste is a common problem in many households. We buy fresh produce with the best of intentions, only to have it spoil in the back of the refrigerator before we get a chance to eat it. When you use BNPL for groceries, this problem takes on a new and more frustrating dimension.

You could find yourself in the absurd situation of making the final payment on a bag of salad that you threw away two weeks ago. This experience can be deeply demoralizing, highlighting the folly of financing short-lived consumables and adding financial insult to the injury of wasted food.

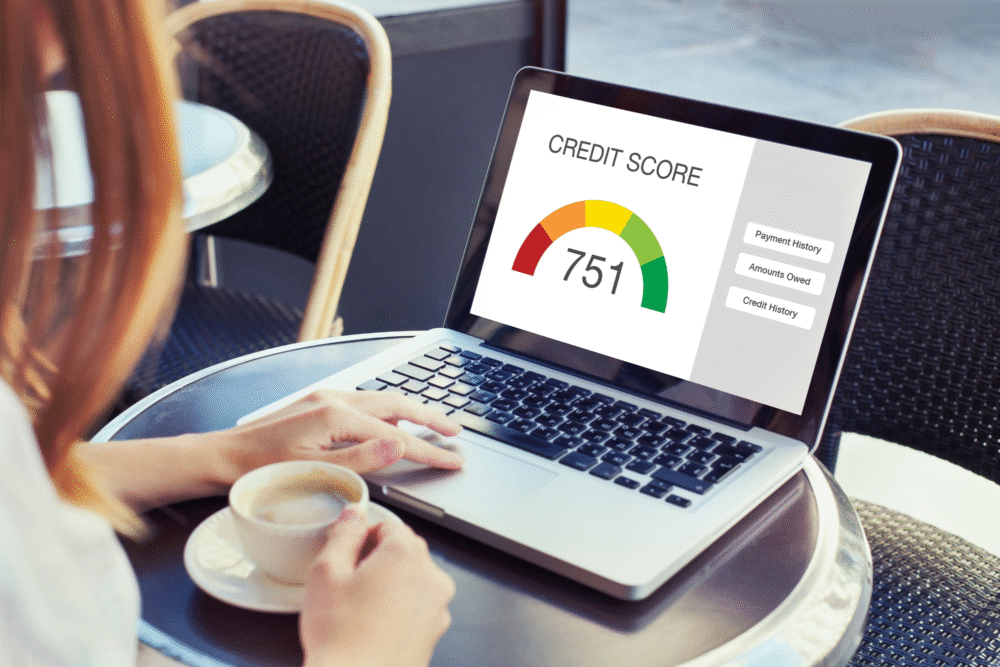

7. Missed payments can still damage your credit score.

Initially, one of the appeals of BNPL was that it often did not involve a hard credit check and was not reported to the major credit bureaus. That is changing rapidly. The major credit bureaus—Equifax, Experian, and TransUnion—are now incorporating BNPL payment history into their credit reports.

This means that a missed or late payment on your grocery bill can now directly harm your credit score. This can make it more difficult and expensive for you to get approved for major loans, like a mortgage or a car loan, in the future. The stakes are now much higher than just a simple late fee.

8. It masks the real problem of financial instability.

Using BNPL for an essential living expense like food is often a symptom of a deeper financial problem: a lack of emergency savings or insufficient income to cover basic needs. While it may feel like a helpful tool in the moment, it is merely a temporary patch that can mask the underlying issue and prevent you from seeking a more sustainable solution.

Relying on this type of credit for necessities can delay the important work of creating a realistic budget, cutting unnecessary expenses elsewhere, or seeking ways to increase your income. It provides a false sense of security while your overall financial situation may be deteriorating.

9. It turns a basic need into a recurring debt cycle.

Groceries are not a one-time purchase; they are a constant, recurring expense that you will have for the rest of your life. Using an installment loan to finance a recurring expense is one of the most dangerous debt traps you can fall into. You will be tempted to use it again and again, creating a perpetual cycle of debt for your daily food.

This normalizes the idea of being constantly in debt for the most basic of needs. It’s a significant psychological shift that erodes the principles of living within your means and saving for the future, turning your grocery budget into a source of stress and financial obligation.