For a generation that grew up online, the stock market is just another app.

In the grand chronicle of generational shifts, the way Gen Z interacts with money may be one of the most profound. This is a generation defined by its digital nativity, its embrace of the side hustle, and its inherent skepticism of traditional institutions. It only makes sense that their entry into the world of investing would not be through a stuffy office in a financial district, but through a sleek app on their phone.

Robinhood didn’t just build a brokerage; it built a financial tool that speaks the native language of this generation. It tapped into their values, habits, and aspirations, becoming less of a simple investment platform and more of an essential component of their digital-first financial lives.

1. It was the first brokerage that felt like a social media app.

Gen Z grew up on a diet of intuitive, beautifully designed apps like Instagram and TikTok. Robinhood was the first financial company to understand that the user experience was just as important as the underlying service. With its clean interface, simple gestures, and even its once-controversial digital confetti, it made the act of investing feel familiar, engaging, and native to the smartphone environment.

This design philosophy was a radical departure from the spreadsheet-like aesthetic of older brokerage apps. It made the stock market feel like another feed to scroll through, another part of their digital world, which dramatically lowered the psychological barrier to entry.

2. Fractional shares made investing in their favorite brands a reality.

Gen Z has a strong affinity for the major tech and consumer brands that shape their daily lives, from Apple and Tesla to Amazon and Nike. The problem was that a single share of these companies was often prohibitively expensive. Robinhood’s introduction of fractional shares was a game-changer that allowed them to invest in the companies they actually knew and used, even with just a few dollars.

This feature transformed the abstract concept of “the stock market” into a tangible act of ownership in the brands that are central to their culture. The ability to buy $10 worth of Tesla stock made investing feel personal, relevant, and for the first time, truly accessible.

3. The easy access to crypto captured the digital currency wave.

No generation is more open to the promise of decentralized, digital currency than Gen Z. They grew up in a world where digital assets, from in-game currencies to NFTs, are a normal part of life. Robinhood recognized this trend early and made buying and selling cryptocurrencies like Bitcoin and Dogecoin incredibly simple and accessible.

By integrating crypto trading seamlessly into the same platform as stock trading, Robinhood became the go-to entry point for millions of young people curious about the crypto space. It legitimized crypto as an asset class worth exploring, right alongside traditional stocks, and captured a huge wave of enthusiasm.

4. The free stock referral program was a viral growth hack.

Gen Z is a generation of creators and connectors, and they are highly receptive to peer-to-peer recommendations. Robinhood’s referral program, which offered both the referrer and the new user a free share of stock, was a stroke of marketing genius. It turned its user base into an army of evangelists and created a powerful viral loop.

The element of surprise—not knowing which stock you would get—added a fun, gamified element to the process. This program was perfectly tuned to the social dynamics of this generation, driving explosive growth through word-of-mouth and social media shares.

5. The gamified elements made investing feel less intimidating.

For decades, investing was presented as a serious, complex, and intimidating affair, filled with jargon and scary-looking charts. Robinhood’s design incorporated elements that made the experience feel more like a game, which, while controversial, was highly effective at reducing that initial fear factor for new investors.

The simple green and red color scheme, the satisfying swipes to place a trade, and the real-time portfolio value updates all contributed to an experience that felt more engaging and less daunting. It reframed investing as an activity that could be approachable and even enjoyable, not just stressful.

6. It provides a powerful sense of control and direct market access.

This is a generation that values autonomy and distrusts intermediaries. The traditional model of handing your money over to a financial advisor felt opaque and out of their control. Robinhood offered the complete opposite: a direct, unmediated connection to the financial markets. They could make their own decisions and execute their own trades in real time.

This sense of empowerment and direct control is a core part of the app’s appeal. It aligns with the DIY ethos of Gen Z, giving them the tools to take charge of their own financial destiny without having to ask for permission from a traditional gatekeeper.

7. The app serves as a practical, hands-on educational tool.

While critics have worried about the risks, for many Gen Z users, Robinhood has served as their first real, practical education in how the markets work. The app’s simplicity makes it a low-stakes environment to learn the basics by doing. You can learn what a market order is, see how stock prices fluctuate during the day, and track the performance of companies you follow.

Combined with its library of simple educational content, the app functions as an interactive learning lab. It has likely done more to teach the basics of market mechanics to this generation than any high school economics class ever could.

8. It aligns with the side-hustle culture of creating new income streams.

Gen Z has normalized the idea of the side hustle, the belief that you should have multiple streams of income beyond your primary job. Investing fits perfectly into this mindset. It is viewed as another potential way to make money work for you, another hustle that can be managed from your phone in the downtime between classes or other gigs.

Robinhood’s accessibility and ease of use make it the perfect tool for this mentality. It allows a young person to seamlessly move money from their DoorDash earnings or their Etsy sales directly into the stock market, treating investing as an integral part of their diversified income strategy.

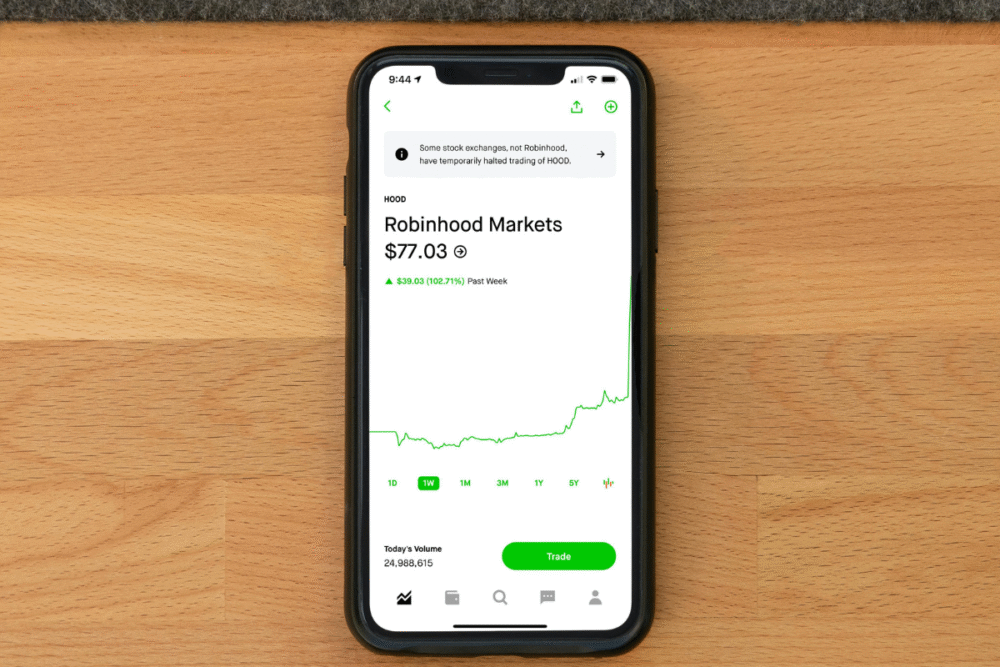

9. The “meme stock” era cemented its cultural relevance.

The GameStop and AMC saga was a defining cultural moment for Gen Z, a David vs. Goliath story that pitted retail investors against Wall Street hedge funds. Robinhood was the primary arena where this battle took place. The app became a household name overnight, inextricably linked with this powerful movement of collective, social investing.

This event, while controversial for Robinhood itself, cemented its status as the de facto platform for this new era of investing. It proved that the app was not just a tool, but a cultural force capable of shaping market narratives.

10. It offers financial products that are relevant to their lives now.

Robinhood has evolved beyond just a trading app. By adding features like a high-yield cash sweep program and an IRA with a company match, it is offering financial products that are directly relevant to the immediate needs of a young person. The high-yield cash account is a powerful alternative to a traditional savings account, and the IRA match is a unique incentive to start saving for retirement early.

These features show that the company understands the full financial life cycle of its users, not just their desire to trade. This makes the app feel like a more holistic financial partner for a generation just starting to build their wealth.