Earning money is one thing, but managing it well is another.

Gen Z is entering adulthood during an uncertain financial time, with high living costs and unstable job markets. Many are learning about money the hard way, without the safety nets previous generations leaned on.

It’s not about being careless—it’s about navigating new challenges with little guidance. Here are ten money mistakes Gen Z commonly makes and what they mean for financial security.

1. Treating credit cards like free cash.

Credit cards feel empowering, but interest rates hit hard. Spending freely without a payoff plan leaves balances spiraling.

Many young people underestimate how quickly debt grows. What starts as convenience can end as a long-term burden.

2. Ignoring emergency savings.

Living paycheck to paycheck without a cushion makes any setback feel devastating. Unexpected bills or job loss can wreck a budget overnight.

Even a few hundred dollars set aside changes everything. The mistake is waiting until “later” to start saving.

3. Relying too heavily on Buy Now, Pay Later.

Splitting payments sounds smart, but it often leads to overspending. Small amounts add up fast when several plans run at once.

It shifts focus away from affordability and toward immediate gratification. The result is juggling payments instead of managing money.

4. Skipping retirement contributions.

Retirement feels decades away, so many push off investing. But time is the most powerful tool for building wealth.

Delaying even a few years reduces long-term growth. The earlier contributions start, the easier retirement becomes.

5. Not tracking expenses.

Money disappears quickly when you don’t know where it goes. Apps make tracking easier, but many still avoid the habit.

Without awareness, overspending sneaks in unnoticed. Tracking is the first step to control.

6. Falling for “get rich quick” trends.

Social media is full of investment gurus promising instant success. Crypto, meme stocks, and risky flips lure many into losses.

Building wealth is rarely fast or flashy. Chasing shortcuts often leads to regret.

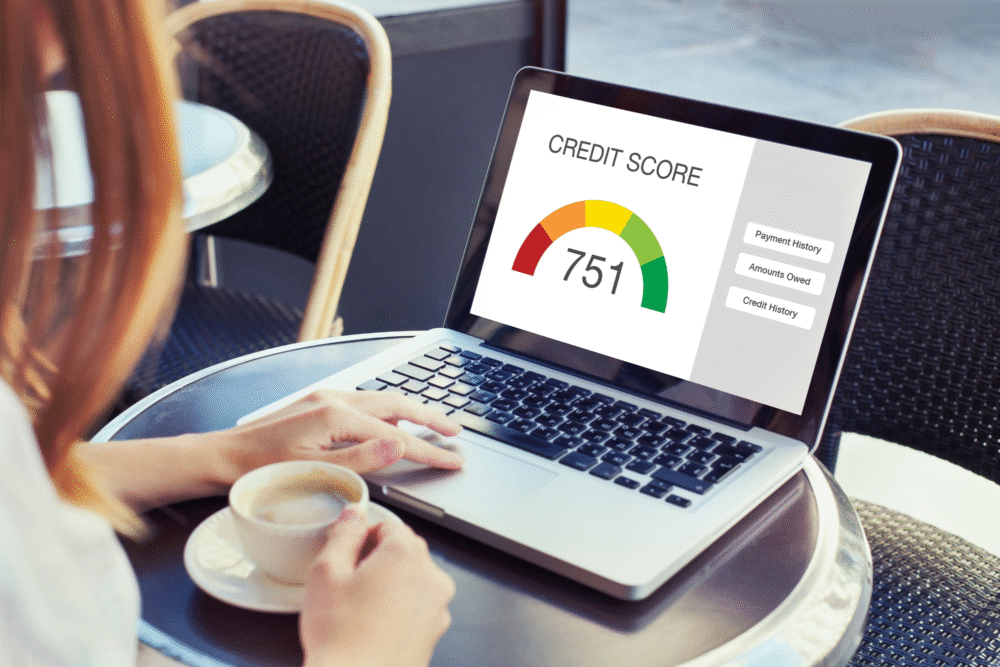

7. Neglecting credit scores.

Credit scores affect loans, rentals, and even jobs. Ignoring them until you need them is a costly mistake.

Simple habits like paying bills on time and keeping balances low build strong scores. The earlier you start, the better.

8. Spending without budgeting.

Budgets sound restrictive, but they’re actually freeing. Without one, spending tends to drift with no plan.

A budget creates clarity and direction. The mistake is assuming you can wing it without consequences.

9. Forgetting about interest rates.

Loans and credit cards come with interest that compounds fast. Many don’t calculate how much extra they’re really paying.Ignoring rates leads to expensive debt that lingers for years. Awareness is the first line of defense.

10. Underestimating lifestyle creep.

As income rises, spending often rises too. More money doesn’t mean more stability if it all goes out the door.

Failing to control lifestyle inflation leaves little room for saving. The key is recognizing when wants are disguised as needs.